Unified Pension Scheme (UPS): Everything You Need to Know in 2025

Your Finances Team

Author

Ready to decode the pension game that's about to change everything for government employees? The Unified Pension Scheme (UPS) just dropped and it's literally the pension revolution we've been waiting for.

Whether you're planning your career moves or trying to understand what your parents are talking about at dinner, this guide will break down everything about UPS in simple terms.

No cap, this is going to be huge for India's workforce! 🔥

What is the Unified Pension Scheme (UPS)?

The Unified Pension Scheme (UPS) is India's latest pension reform initiative designed to provide financial security to government employees after retirement. Announced in 2024, this scheme aims to bridge the gap between the old pension system and the National Pension System (NPS), offering a balanced approach to retirement planning.

The UPS represents a significant shift in India's pension landscape, combining the best features of traditional pension schemes with modern investment principles. This hybrid model ensures that government employees receive adequate retirement benefits while maintaining fiscal sustainability for the government.

Key Features of the Unified Pension Scheme

The UPS introduces several revolutionary features that make it stand out from existing pension schemes:

Assured Pension Benefits: Unlike the NPS, which is market-linked, the UPS guarantees a minimum pension amount, providing certainty to employees about their post-retirement income.

Family Pension Provision: The scheme includes provisions for family pension, ensuring that the dependents of deceased employees receive financial support.

Inflation Protection: The UPS incorporates mechanisms to protect pensioners from inflation, maintaining their purchasing power over time.

Voluntary Contributions: Employees can make additional voluntary contributions to enhance their retirement corpus, similar to the NPS structure.

Understanding India's Pension Evolution

To fully appreciate the significance of the UPS, it's essential to understand India's pension journey:

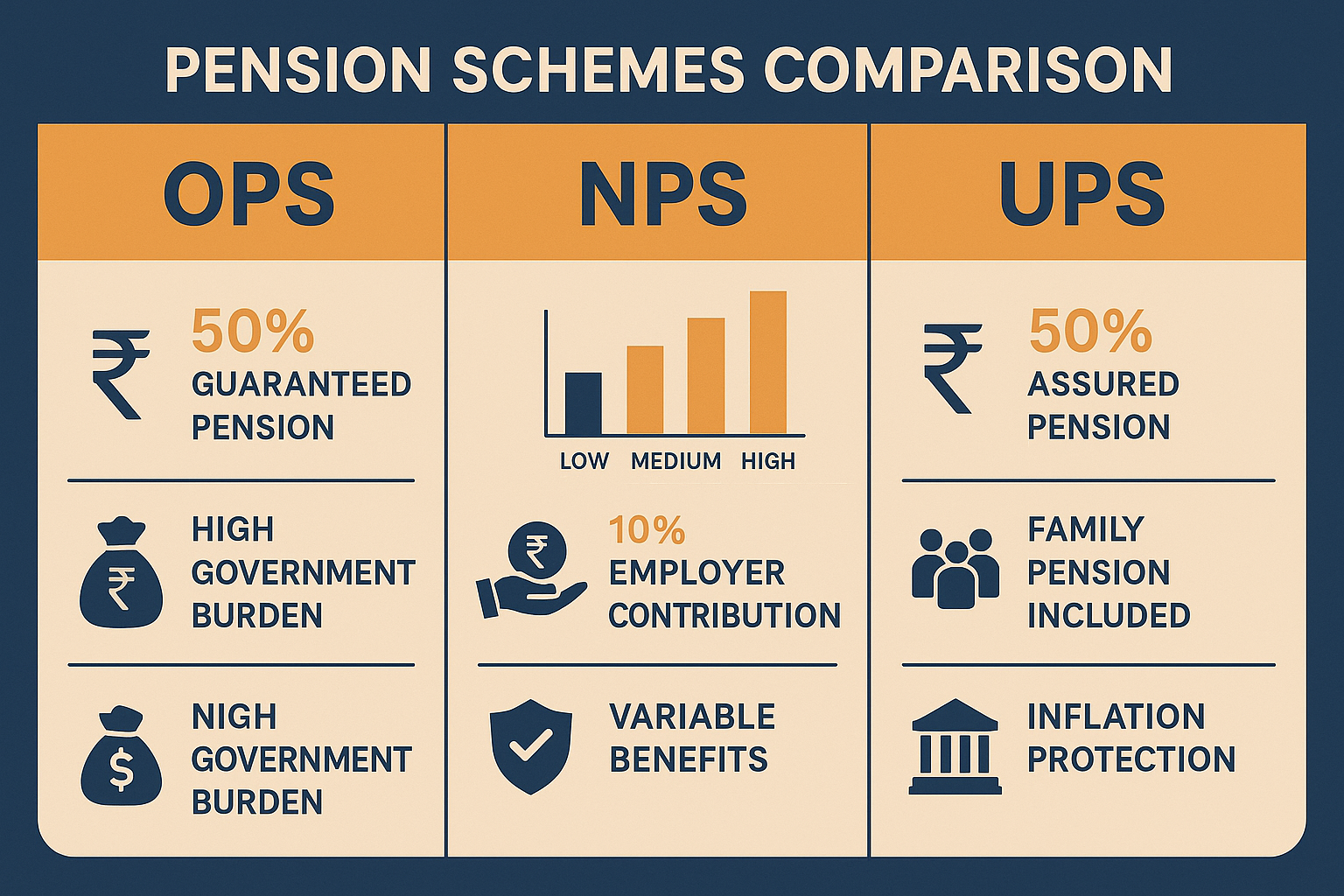

Old Pension Scheme (OPS)

The traditional defined benefit scheme guaranteed 50% of the last drawn salary as pension. While generous, it created significant fiscal burden on state governments, leading to its discontinuation for new employees in most states.

National Pension System (NPS)

Introduced in 2004, the NPS shifted the risk to employees through market-linked returns. While cost-effective for governments, it created uncertainty about retirement income for employees.

Unified Pension Scheme (UPS)

The UPS attempts to balance employee security with fiscal prudence, offering guaranteed benefits while maintaining sustainable financing.

Eligibility Criteria for UPS

The Unified Pension Scheme eligibility encompasses various categories of government employees:

Primary Eligibility Requirements

Central Government Employees: All central government employees recruited after the specified implementation date are automatically covered under UPS.

State Government Employees: State governments can opt to implement UPS for their employees, with each state having the flexibility to decide the timeline.

Public Sector Undertakings: Employees of PSUs may be included based on their organization's decision to adopt the scheme.

Existing NPS Subscribers: Current NPS subscribers can opt to migrate to UPS under specific conditions and timelines.

Age and Service Requirements

The UPS maintains standard government service requirements:

- Minimum qualifying service of 10 years for pension eligibility

- Minimum age of 25 years for family pension benefits

- Maximum entry age typically aligned with recruitment rules

Migration Options

Employees currently under NPS have a one-time option to migrate to UPS, subject to:

- Payment of differential contributions

- Acceptance of revised benefit calculations

- Compliance with migration timeline requirements

UPS Benefits and Calculation Methods

The benefit structure of the Unified Pension Scheme is designed to provide comprehensive retirement security:

Pension Calculation Formula

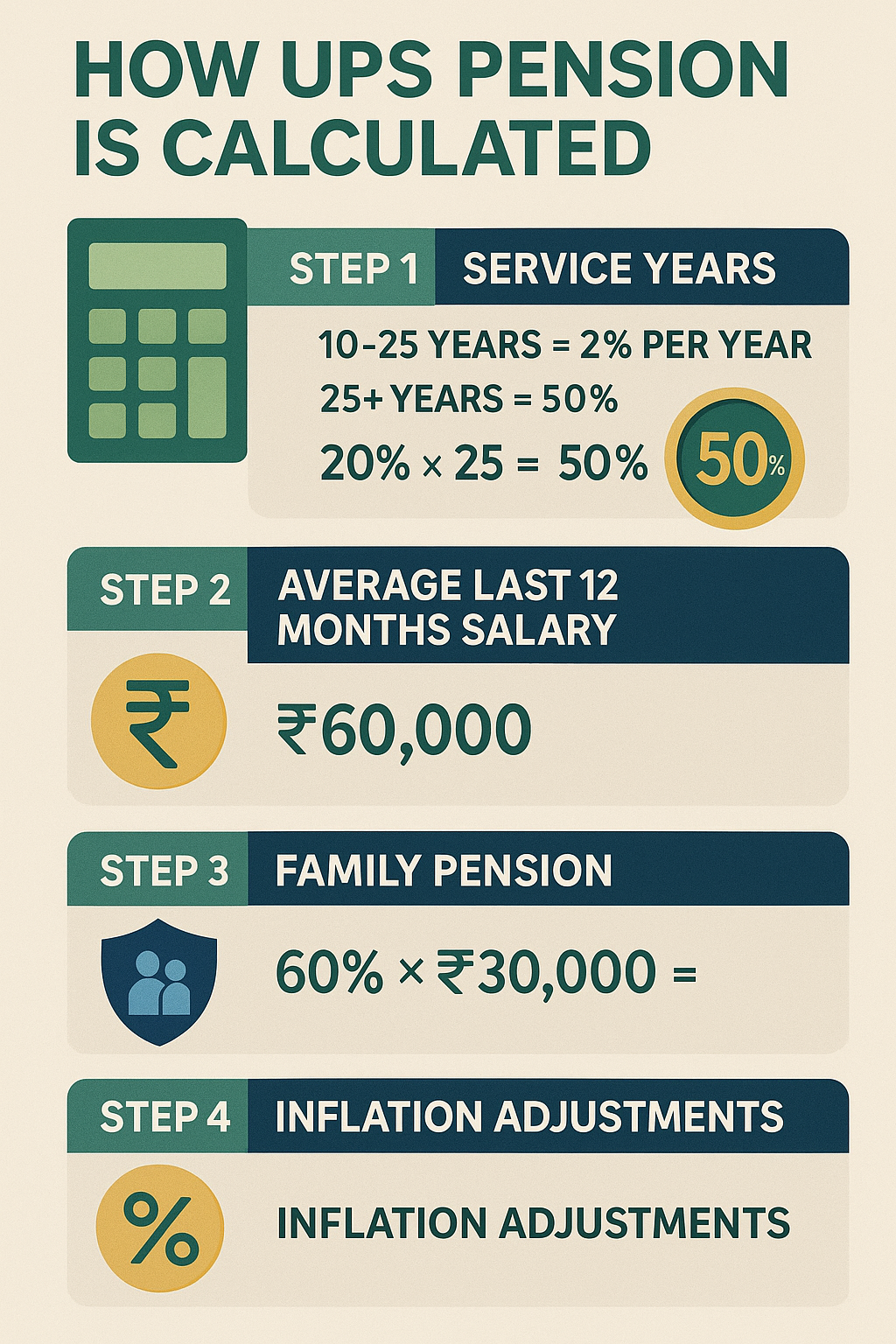

The UPS pension calculation follows a defined benefit approach:

Basic Pension: 50% of the average emoluments drawn during the last 12 months of service, subject to minimum qualifying service of 25 years.

Proportionate Pension: For service between 10-25 years, pension is calculated proportionately at 2% per year of qualifying service.

Minimum Pension Guarantee: The scheme ensures a minimum pension amount, providing a safety net for all beneficiaries.

Family Pension Benefits

The UPS family pension provisions include:

Spouse Pension: 60% of the employee's pension or the pension the employee was receiving at the time of death.

Children's Pension: Additional benefits for dependent children, typically until they reach majority or complete education.

Dependent Parents: In cases where there is no spouse or children, dependent parents may be eligible for family pension.

Dearness Relief and Inflation Protection

The UPS incorporates automatic dearness relief adjustments:

- Bi-annual revision based on cost of living indices

- Protection against inflation erosion

- Maintenance of real purchasing power

Implementation Timeline and Process

The UPS implementation follows a phased approach across different levels of government:

Central Government Implementation

The central government has announced the implementation of UPS for its employees:

- Phase 1: Policy framework development and regulatory approvals

- Phase 2: System integration and employee enrollment

- Phase 3: Full operational implementation

State Government Adoption

State governments have the autonomy to adopt UPS:

- Voluntary Adoption: States can choose to implement UPS based on their fiscal capacity

- Timeline Flexibility: Each state can set its own implementation schedule

- Central Support: Technical and financial assistance available from the central government

Migration Process for Existing Employees

The transition process for current NPS subscribers includes:

- Option Period: Specific timeframe for employees to choose migration

- Financial Reconciliation: Calculation of differential contributions and benefits

- Documentation: Completion of required paperwork and approvals

UPS vs NPS: Comprehensive Comparison

Understanding the differences between UPS and NPS helps employees make informed decisions:

Benefit Structure Comparison

UPS Benefits:

- Guaranteed pension amount

- Family pension provisions

- Inflation protection

- Government backing for benefits

NPS Benefits:

- Market-linked returns

- Flexibility in investment choices

- Partial withdrawal options

- Tax benefits under Section 80C and 80CCD

Risk and Return Profile

UPS Risk Profile:

- Low risk due to government guarantee

- Predictable returns

- Protection from market volatility

- Assured income stream

NPS Risk Profile:

- Market-linked risk

- Potential for higher returns

- Exposure to market fluctuations

- Variable income stream

Contribution Requirements

UPS Contributions:

- Fixed contribution rates

- Government matching contributions

- Transparent calculation methods

- Simplified compliance

NPS Contributions:

- Flexible contribution options

- Employer and employee contributions

- Additional voluntary contributions

- Investment choice flexibility

Financial Implications and Sustainability

The financial aspects of UPS require careful consideration from multiple perspectives:

Government Financial Impact

The UPS implementation affects government finances through:

- Increased Liability: Higher pension obligations compared to NPS

- Fiscal Planning: Need for long-term financial planning

- Budget Allocation: Dedicated budget provisions for pension payments

- Actuarial Calculations: Regular assessment of scheme sustainability

Employee Financial Benefits

Employees benefit financially through:

- Predictable Income: Guaranteed pension amounts

- Family Security: Comprehensive family pension provisions

- Inflation Protection: Maintained purchasing power

- Reduced Anxiety: Elimination of market risk concerns

Economic Impact on India

The broader economic implications include:

- Consumer Spending: Increased confidence in retirement planning

- Social Security: Enhanced social safety net

- Fiscal Balance: Impact on government debt and expenditure

- Economic Stability: Reduced dependence on volatile market returns

Registration and Enrollment Process

The UPS enrollment process is designed to be employee-friendly and efficient:

Required Documentation

Employees need to provide:

- Service Records: Complete employment history and service details

- Personal Information: Identity proof, address verification, and family details

- Bank Details: Account information for pension payments

- Nomination Forms: Beneficiary details for family pension purposes

Online Registration Process

The digital enrollment system includes:

- Portal Access: Dedicated UPS enrollment website

- Document Upload: Digital submission of required documents

- Verification Process: Online verification and approval workflow

- Confirmation: Digital acknowledgment and registration completion

Offline Registration Options

For employees preferring traditional methods:

- Form Submission: Physical forms available at government offices

- Document Verification: In-person verification at designated centers

- Manual Processing: Traditional paperwork processing options

- Support Services: Help desk assistance for completion

Tax Implications of UPS

Understanding the tax treatment of UPS is crucial for effective financial planning:

Contribution Tax Benefits

UPS contributions qualify for tax benefits under:

- Section 80C: Deduction up to ₹1.5 lakhs for employee contributions

- Section 80CCD(1): Additional deduction for government employees

- Section 80CCD(2): Employer contribution exemption from taxable income

- Section 80CCD(1B): Additional deduction for voluntary contributions

Pension Taxation

UPS pension payments are subject to:

- Taxable Income: Pension treated as salary income for tax purposes

- Tax Deduction at Source: TDS applicable on pension payments above threshold

- Standard Deduction: Availability of standard deduction on pension income

- Exemption Limits: Certain exemptions available for senior citizens

Death Benefit Taxation

Family pension taxation includes:

- Taxable Components: Most family pension amounts are taxable

- Exemption Limits: Specific exemptions for family pension recipients

- Documentation Requirements: Proper documentation for tax compliance

- Professional Advice: Recommendation for tax planning consultation

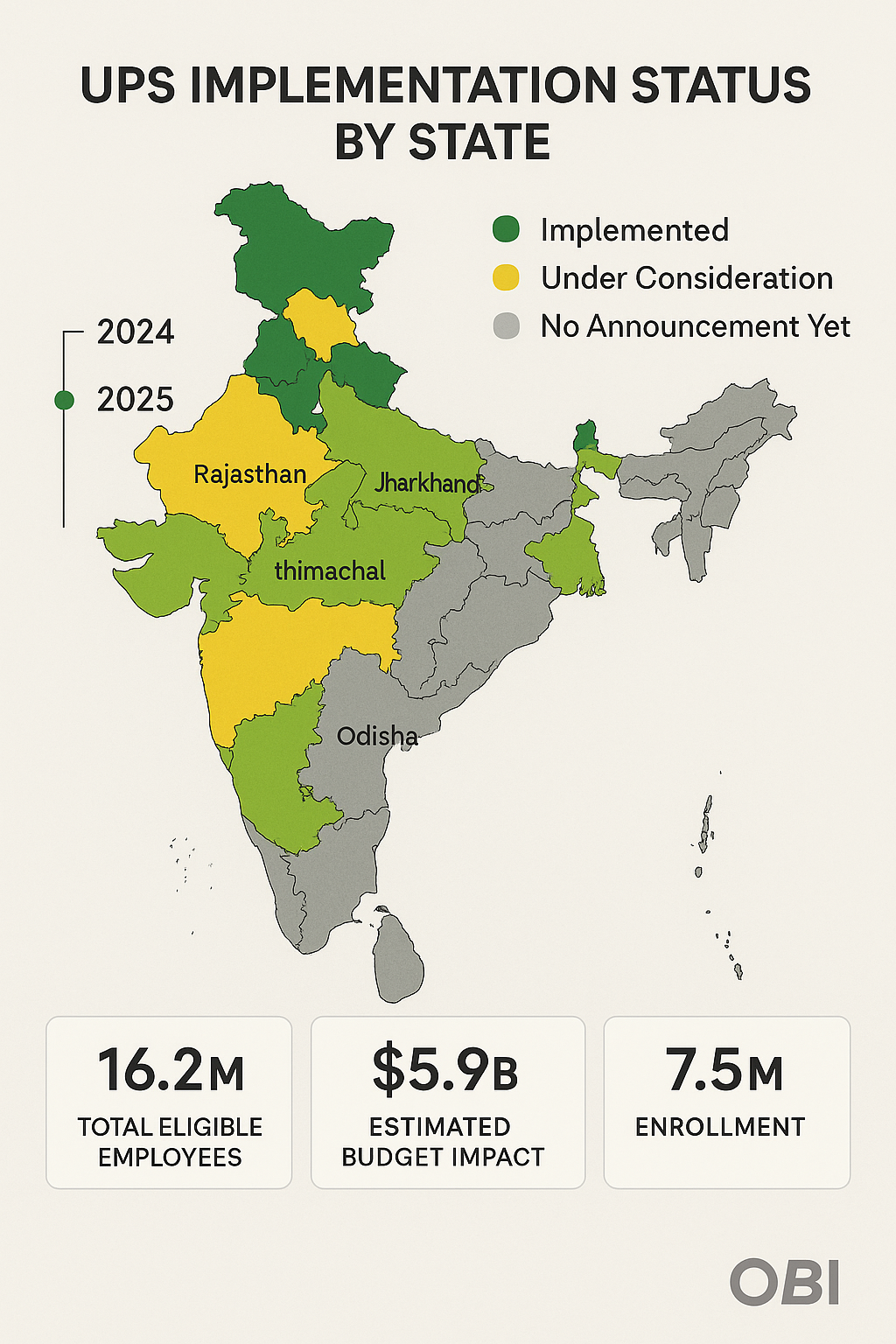

State-wise UPS Implementation Status

The adoption of UPS varies across Indian states based on their fiscal capacity and policy decisions:

Early Adopter States

Several states have announced early implementation:

- Rajasthan: Among the first to announce UPS adoption

- Chhattisgarh: Committed to implementing UPS for state employees

- Jharkhand: Announced transition from NPS to UPS

- Himachal Pradesh: Declared implementation for government employees

States Under Consideration

Many states are evaluating UPS implementation:

- Punjab: Studying fiscal implications of UPS adoption

- Haryana: Considering timeline for implementation

- Uttarakhand: Evaluating benefits for state employees

- Odisha: Analyzing financial feasibility

Implementation Challenges

States face various challenges in UPS adoption:

- Fiscal Capacity: Ability to fund increased pension obligations

- Administrative Setup: Infrastructure requirements for implementation

- Employee Transition: Managing migration from existing schemes

- Political Considerations: Electoral implications of pension decisions

Common FAQs About UPS

General Questions

Q: Is UPS better than NPS for government employees? A: UPS offers guaranteed benefits and family pension, making it more secure than market-linked NPS. However, the choice depends on individual risk appetite and financial goals.

Q: Can private sector employees join UPS? A: Currently, UPS is designed specifically for government employees. Private sector workers continue with NPS or other retirement schemes.

Q: What happens to existing NPS contributions when migrating to UPS? A: Existing NPS contributions are typically transferred to the UPS account, with adjustments made for differential contribution requirements.

Technical Questions

Q: How is the pension amount calculated under UPS? A: Pension is calculated as 50% of average emoluments for 25+ years of service, or proportionately at 2% per year for 10-25 years of service.

Q: Are UPS benefits inflation-indexed? A: Yes, UPS includes provisions for dearness relief adjustments to protect against inflation.

Q: Can employees make additional voluntary contributions to UPS? A: The scheme allows for voluntary contributions to enhance retirement benefits, similar to NPS provisions.

Migration Questions

Q: Is migration from NPS to UPS mandatory? A: No, migration is optional. Employees can choose to remain in NPS or migrate to UPS within the specified timeline.

Q: What is the deadline for UPS migration? A: Migration deadlines vary by employer and are typically announced with reasonable notice periods.

Q: Are there any penalties for late migration to UPS? A: Late migration may involve additional compliance requirements but typically doesn't include financial penalties.

Future Prospects and Developments

The UPS represents a significant evolution in India's pension landscape with several future implications:

Policy Enhancements

Expected developments include:

- Benefit Optimization: Regular review and enhancement of benefit structures

- Coverage Expansion: Potential extension to additional employee categories

- Technology Integration: Advanced digital platforms for better service delivery

- International Benchmarking: Alignment with global pension best practices

Technological Advancements

Digital transformation initiatives may include:

- Blockchain Integration: Secure and transparent pension record management

- AI-Powered Services: Personalized pension planning and advisory services

- Mobile Applications: Comprehensive mobile platforms for pension management

- Data Analytics: Advanced analytics for better scheme administration

Economic Impact Assessment

Long-term economic implications include:

- Fiscal Sustainability: Ongoing assessment of scheme financial viability

- Economic Growth: Impact on consumer spending and economic stability

- Social Security: Enhanced social safety net for retirees

- Intergenerational Equity: Balanced approach to pension obligations

Expert Recommendations and Best Practices

Financial experts and pension specialists recommend several best practices for UPS participants:

Financial Planning Strategies

Comprehensive Retirement Planning: UPS should be part of a broader retirement strategy that includes personal savings, investments, and insurance.

Tax-Efficient Contributions: Maximize tax benefits by optimizing contribution levels and utilizing available deductions.

Regular Review: Periodically review pension projections and adjust financial plans accordingly.

Professional Consultation: Seek advice from qualified financial advisors for personalized planning.

Career Considerations

Service Continuity: Maintain continuous service to maximize pension benefits and avoid breaks that could affect calculations.

Documentation Management: Keep thorough records of service, contributions, and all pension-related documents.

Beneficiary Updates: Regularly update nomination and beneficiary information to ensure family pension security.

Skill Development: Continuous learning and skill enhancement can lead to career progression and higher pension calculations.

Conclusion: The Future of Retirement Security in India

The Unified Pension Scheme represents a landmark achievement in India's journey toward comprehensive social security. By combining the security of guaranteed benefits with the fiscal responsibility of modern pension design, UPS addresses the concerns of both employees and governments.

For Indian government employees, UPS offers the peace of mind that comes with assured retirement income while maintaining the dignity and respect that government service deserves. The scheme's emphasis on family pension and inflation protection demonstrates a holistic approach to retirement planning that considers the Indian family structure and economic realities.

As India continues to evolve as a major global economy, robust social security systems like UPS become increasingly important. The scheme not only provides individual security but contributes to broader economic stability by ensuring predictable retirement income streams.

The success of UPS will depend on effective implementation, adequate funding, and continuous adaptation to changing economic conditions. For current and prospective government employees, understanding UPS and planning accordingly will be crucial for achieving financial security in retirement.

The pension landscape in India has never been more promising, and the Unified Pension Scheme stands as a testament to the government's commitment to employee welfare and national development. As we move forward, UPS will likely serve as a model for other developing nations seeking to balance employee security with fiscal sustainability.

Whether you're just starting your government career or nearing retirement, the UPS offers a foundation for financial security that previous generations could only dream of. By staying informed, planning wisely, and making the most of the opportunities UPS provides, Indian government employees can look forward to a retirement filled with dignity, security, and peace of mind.

Written by

Your Finances Team

Helping Indians make better financial decisions through simple, actionable advice.

Continue Reading

New PSU Pension Rules 2025: Complete Guide to CCS Amendment - 7 Benefits at Risk for Government Employees

Breaking News: What Changed in May 2025 The Government of India issued a critical amendment to pension regulations on May 22, 2025, through G.S.R. 340(E) under the Ministry of Personnel, Public Grieva...

The Complete Guide to June 2025 Financial Changes in India: What Investors Need to Know

June 2025 brings significant financial regulatory changes across India's investment landscape. From SEBI's revised mutual fund transaction timings to anticipated RBI repo rate adjustments and major cr...

Nifty and Bank Nifty Analysis for 26th May 2025 : Mixed Signals Point to Critical Week Ahead

The Indian equity markets are at a crucial juncture, with both Nifty and Bank Nifty displaying contrasting technical and sentiment indicators that suggest significant price movements could be on the h...