New PSU Pension Rules 2025: Complete Guide to CCS Amendment - 7 Benefits at Risk for Government Employees

Your Finances Team

Author

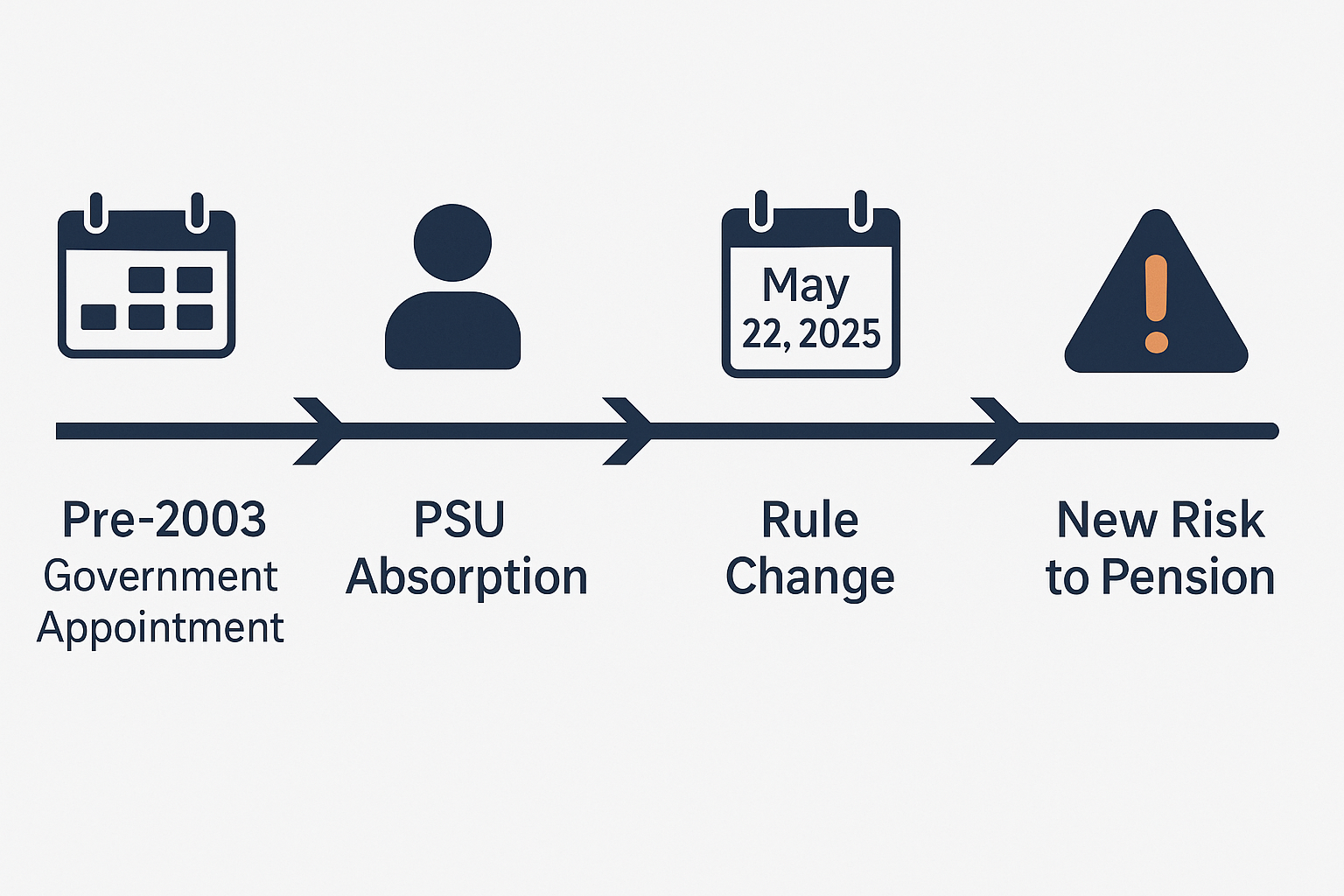

Breaking News: What Changed in May 2025

The Government of India issued a critical amendment to pension regulations on May 22, 2025, through G.S.R. 340(E) under the Ministry of Personnel, Public Grievances and Pensions.

This amendment to Rule 37(29C) of the Central Civil Services (Pension) Rules, 2021, fundamentally changes how pension benefits are protected for PSU employees.

Key Changes Summary

- Effective Date: May 22, 2025 (G.S.R. 340(E))

- Scope: Public Sector Undertaking (PSU) employees who previously served in government

- Impact: Misconduct-based dismissal can now forfeit ALL pension benefits

- Coverage: Employees appointed to government service on or before December 31, 2003

Official Source: Department of Pension & Pensioners' Welfare | DoPT Circulars

Understanding Rule 37(29C): Complete Breakdown

Previous Rule (Before May 2025)

Under the earlier provision, PSU employees retained their government pension benefits even if dismissed from PSU service for misconduct. The rule specifically stated that dismissal "shall not amount to forfeiture of the retirement benefits for the service rendered under the Government."

New Rule 37(29C) - May 2025 Amendment

The revised rule now states:

"The dismissal or removal from service of the public sector undertaking of any employee after his absorption in such undertaking for any subsequent misconduct shall lead to forfeiture of the retirement benefits for the service rendered under the Government also..."

What This Means in Practice

- Before: Government pension remained protected despite PSU dismissal

- After: Both PSU and government pension benefits can be forfeited

- Trigger: Misconduct leading to dismissal or removal from PSU service

- Review: All decisions subject to administrative ministry review

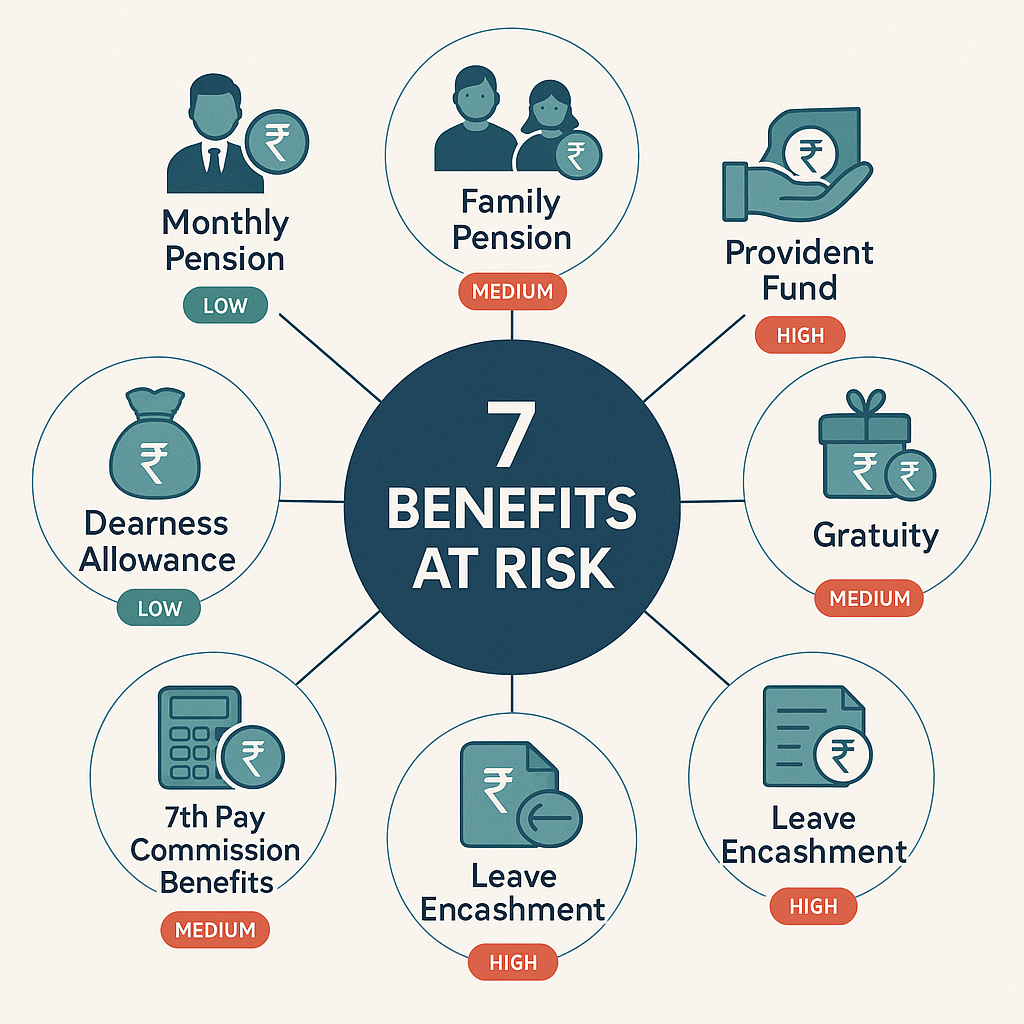

7 Retirement Benefits at Risk

Based on official government notifications, the following retirement benefits are now at risk for dismissed PSU employees:

1. Monthly Pension

- Basic pension amount from government service

- Calculated based on last pay drawn and service period

- Risk Level: Complete forfeiture possible

2. Family Pension

- Benefit payable to family members after employee's death

- Typically 50% of basic pension

- Risk Level: Complete forfeiture possible

3. Provident Fund Benefits

- Accumulated PF from government service period

- Includes employee and employer contributions

- Risk Level: Subject to forfeiture provisions

4. Gratuity

- Lump sum payment based on salary and service period

- Formula: Last drawn salary × 15/26 × completed years of service

- Risk Level: Complete forfeiture possible

5. Dearness Allowance (DA)

- Inflation-linked allowance on pension

- Currently applicable rates for pensioners

- Risk Level: Complete forfeiture possible

6. 7th Pay Commission Benefits

- Enhanced pension under 7th CPC recommendations

- Includes arrears and revised rates

- Risk Level: Complete forfeiture possible

7. Leave Encashment

- Encashment of earned leave (maximum 300 days)

- Calculated at last pay drawn rates

- Risk Level: Subject to CCS (Leave) Rules provisions

Who is Affected: Eligibility Criteria

Target Group

The amendment specifically applies to employees who meet ALL of the following criteria:

- Original Appointment: Government service on or before December 31, 2003

- Current Status: Absorbed in Public Sector Undertaking

- Service Type: Transferred en-masse during departmental conversion to PSU

- Risk Factor: Potential for misconduct-based dismissal

PSU Categories Covered

- Maharatna PSUs

- Navratna PSUs

- Miniratna PSUs

- Other Central PSUs

- Departmental undertakings converted to PSU status

Estimated Impact

According to government data, approximately 2.5 lakh employees across 56 major PSUs could potentially be affected by this rule change.

Administrative Safeguards and Appeal Process

Built-in Protection Mechanisms

1. Administrative Ministry Review

- Mandatory Review: All dismissal decisions must be reviewed by the administrative ministry

- Authority: Ministry administratively concerned with the specific PSU

- Timeline: Review must be completed before pension forfeiture

- Standard: Alignment with CCS Rules 7, 8, 41, and 44(5)(a) & (b)

2. Due Process Requirements

- Fair inquiry before dismissal

- Opportunity for employee representation

- Adherence to natural justice principles

- Documentary evidence requirements

3. Appeal Mechanisms

- First Appeal: To the appointing authority's superior

- Second Appeal: Administrative ministry level

- Final Resort: Central Administrative Tribunal (CAT)

- Legal Route: High Court under Article 226

Legal Safeguards

- Constitutional protection under Article 14 (Equality)

- Service jurisprudence protection

- Pension as property right doctrine

- Procedural fairness requirements

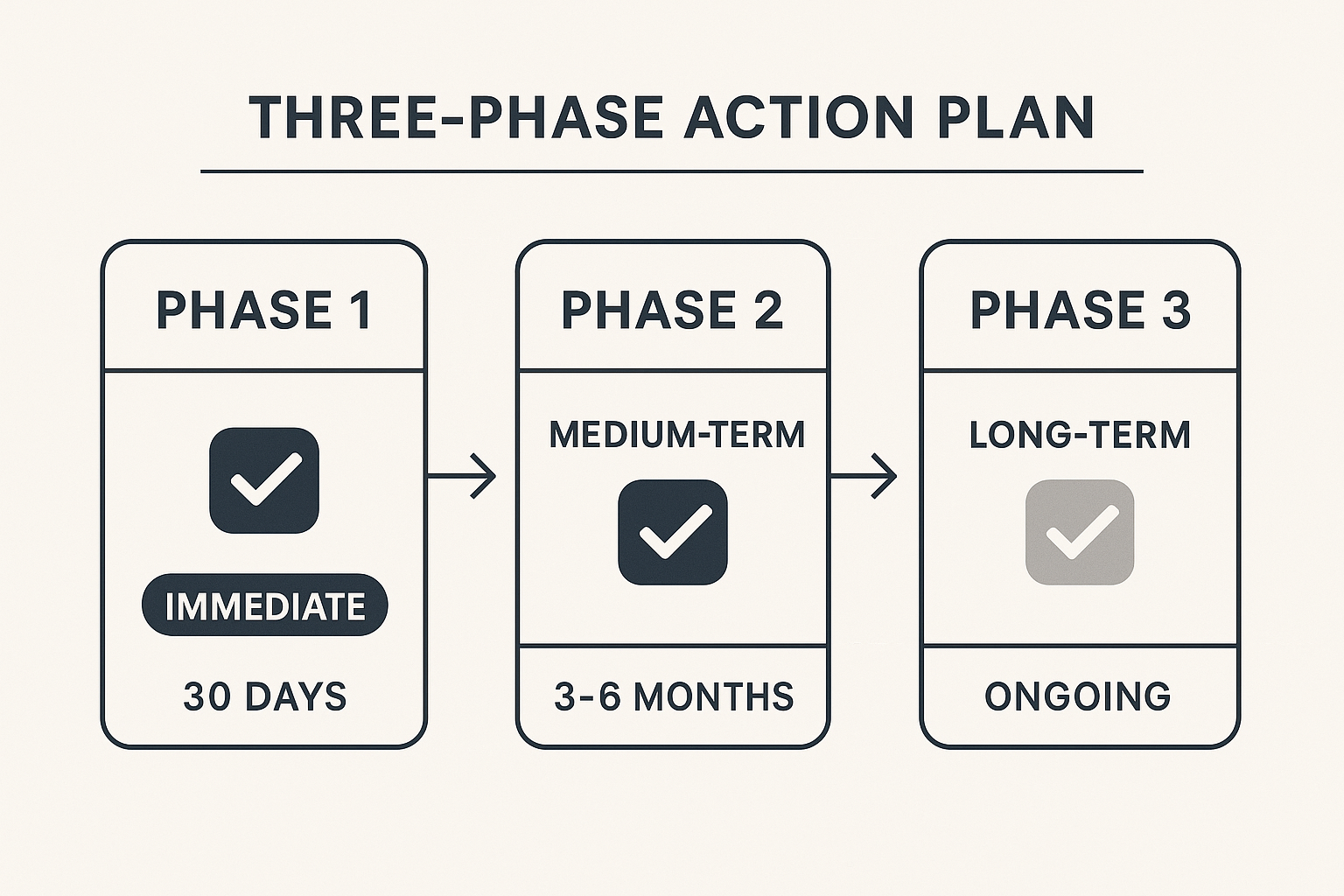

Immediate Action Steps for PSU Employees

For Current PSU Employees (Pre-2003 Appointees)

Immediate Actions (Next 30 Days)

- Document Review

- Obtain copy of original government appointment order

- Collect all service records from government period

- Gather absorption/transfer documentation

- Secure pension calculation worksheets

- Risk Assessment

- Review current performance records

- Address any pending disciplinary matters

- Ensure compliance with PSU conduct rules

- Document any ongoing proceedings

- Legal Preparation

- Consult pension law specialist

- Understand PSU-specific conduct rules

- Review appeal mechanisms

- Consider legal insurance options

Medium-term Strategy (3-6 Months)

- Performance Enhancement

- Focus on exemplary conduct

- Document positive contributions

- Seek performance certifications

- Build strong work record

- Knowledge Building

- Understand revised pension rules

- Stay updated on government circulars

- Join employee unions for support

- Attend pension awareness sessions

Long-term Protection (Ongoing)

- Financial Planning

- Diversify retirement planning beyond pension

- Consider additional investment options

- Evaluate insurance coverage

- Plan for contingencies

- Professional Conduct

- Maintain highest ethical standards

- Avoid any conflict of interest

- Document all decisions and actions

- Seek guidance on ambiguous situations

For Families and Dependents

- Awareness Building: Understand implications for family pension

- Documentation: Ensure all nominee documents are updated

- Alternative Planning: Consider life insurance and investment options

- Legal Understanding: Know appeal rights and procedures

Expert Analysis and Long-term Implications

Government's Perspective

The amendment serves multiple policy objectives:

- Accountability Enhancement: Creates stronger deterrent against misconduct

- Public Sector Discipline: Raises conduct standards across PSUs

- Financial Prudence: Protects public money from undeserving recipients

- Governance Reform: Aligns PSU standards with government service norms

Employee Concerns

The amendment raises several legitimate concerns:

- Retrospective Application: Affects employees who joined under different rules

- Disproportionate Penalty: Complete pension loss may be excessive for minor misconduct

- Arbitrary Risk: Potential for misuse in employer-employee disputes

- Family Impact: Affects dependents who had no role in misconduct

Legal Expert Opinion

Constitutional law experts suggest the amendment may face legal challenges on grounds of:

- Prospective vs. Retrospective Application

- Proportionality of Punishment

- Legitimate Expectation Doctrine

- Fundamental Right to Livelihood

Economic Impact Analysis

- Individual Level: Potential loss of ₹15-25 lakh average pension corpus

- Family Level: Loss of financial security for dependents

- Systemic Level: Improved governance standards across PSU sector

- Market Level: Potential impact on PSU performance and accountability

Frequently Asked Questions (FAQs)

Q1: Does this rule apply to all PSU employees?

A: No, it only applies to employees who were originally appointed to government service on or before December 31, 2003, and later absorbed into PSUs.

Q2: What constitutes "misconduct" under this rule?

A: Misconduct is defined as per the respective PSU's conduct rules and generally includes corruption, insubordination, unauthorized absence, and breach of discipline.

Q3: Can the decision be appealed?

A: Yes, all dismissal decisions are subject to review by the administrative ministry, and employees have appeal rights through established channels.

Q4: Are there any exceptions to this rule?

A: The rule provides for administrative ministry review, which may consider exceptional circumstances, but specific exceptions are not detailed in the amendment.

Q5: How does this affect current pensioners?

A: This rule applies only to active PSU employees. Current pensioners are not affected unless they face post-retirement proceedings.

Official Resources and Further Reading

Government Sources

Legal Resources

- Central Civil Services (Pension) Rules, 2021

- Central Civil Services (Conduct) Rules, 1964

- Central Administrative Tribunal procedures

Professional Assistance

- Pension law specialists

- Employee union representatives

- Financial planning advisors

- Legal aid services

Conclusion

The May 2025 amendment to CCS Pension Rules represents a significant shift in pension security for PSU employees. While it aims to enhance accountability and governance standards, it also creates new vulnerabilities for employees who joined government service under different expectations.

Key Takeaways:

- Understand Your Risk: Assess your personal situation and potential exposure

- Maintain Excellence: Focus on exemplary conduct and performance

- Stay Informed: Keep updated on rule interpretations and legal developments

- Plan Alternatives: Diversify retirement planning beyond government pension

- Seek Guidance: Consult experts for personalized advice

The rule's ultimate impact will depend on its implementation, judicial interpretation, and potential future modifications based on stakeholder feedback and legal challenges.

Disclaimer

This article is for informational purposes only and does not constitute legal or financial advice. Individuals should consult qualified professionals for advice specific to their circumstances

Written by

Your Finances Team

Helping Indians make better financial decisions through simple, actionable advice.

Continue Reading

The Complete Guide to June 2025 Financial Changes in India: What Investors Need to Know

June 2025 brings significant financial regulatory changes across India's investment landscape. From SEBI's revised mutual fund transaction timings to anticipated RBI repo rate adjustments and major cr...

Unified Pension Scheme (UPS): Everything You Need to Know in 2025

Ready to decode the pension game that's about to change everything for government employees? The Unified Pension Scheme (UPS) just dropped and it's literally the pension revolution we've been waiting ...

Nifty and Bank Nifty Analysis for 26th May 2025 : Mixed Signals Point to Critical Week Ahead

The Indian equity markets are at a crucial juncture, with both Nifty and Bank Nifty displaying contrasting technical and sentiment indicators that suggest significant price movements could be on the h...