Money Management Guide for 20-Somethings: Indian Financial Planning Made Simple

Your Finances Team

Author

Your twenties are the most crucial decade for building wealth and achieving financial independence in India.

With rising inflation, increasing living costs, and the need for financial security, the money decisions you make now will compound over the next 40+ years.

This comprehensive guide reveals seven proven strategies tailored for young Indians to build lasting prosperity.

Why Your 20s Are Critical for Wealth Building in India

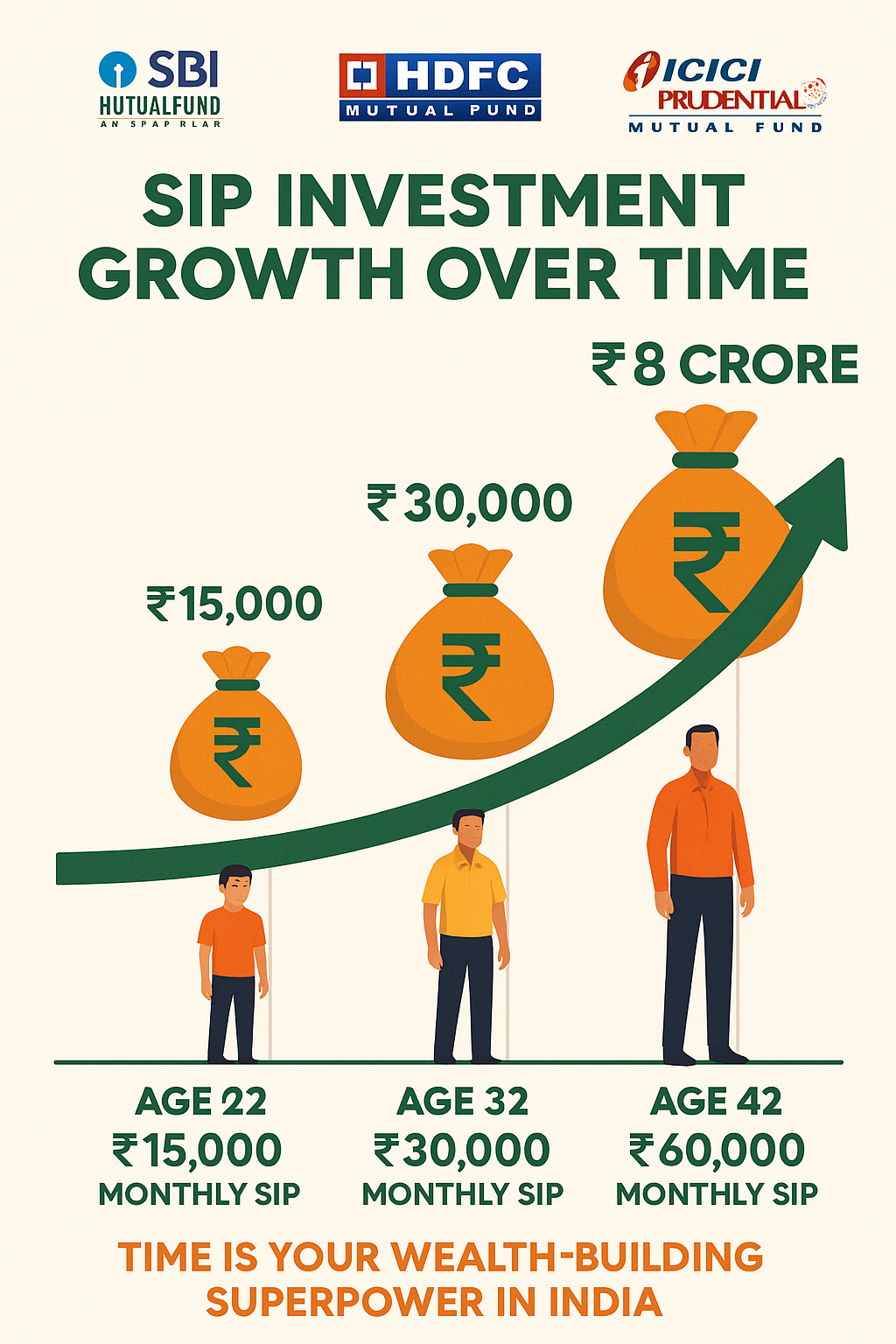

Starting early gives you the most powerful wealth-building tool: time. A 22-year-old who invests ₹15,000 monthly in equity mutual funds can accumulate over ₹8 crores by retirement, while someone starting at 32 with the same SIP will have only ₹3.5 crores. That's the magic of compound interest working in your favor in the Indian market.

1. Master the Art of Budgeting (Your Financial GPS)

Why it matters: Without a budget, you're financially directionless. Many young Indians struggle with money management due to lack of financial planning and increasing lifestyle expenses.

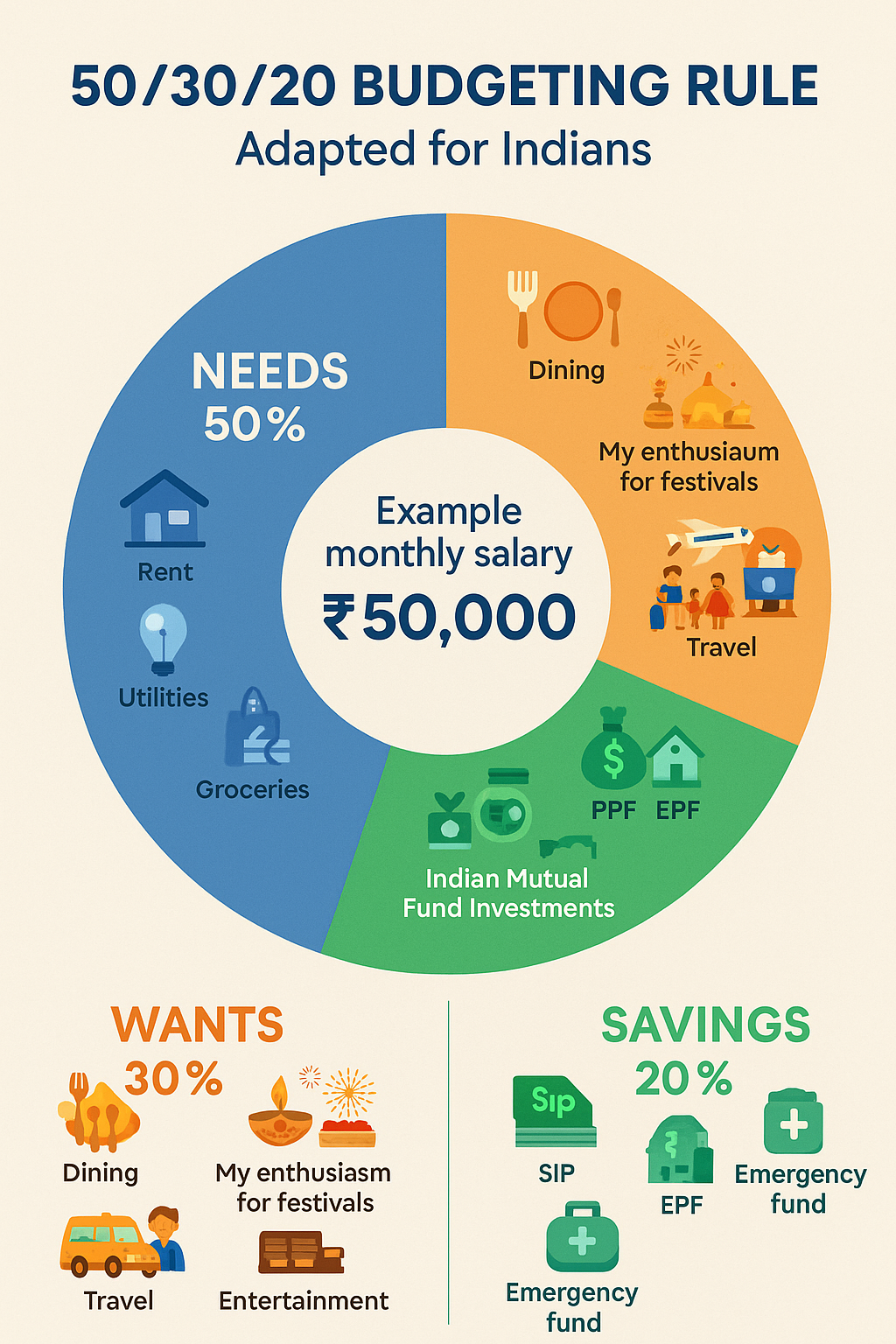

The 50/30/20 Rule Adapted for India:

- 50% for needs: Rent, utilities, groceries, EMIs, family support

- 30% for wants: Entertainment, dining out, shopping, travel

- 20% for savings: Emergency fund, SIPs, insurance, PPF

Indian-Specific Budgeting Tips:

- Account for family expenses: Include contributions to parents/family

- Plan for festivals: Set aside money for Diwali, weddings, and celebrations

- Use UPI expense tracking: Leverage apps like CRED, ET Money, or Paytm for spending analysis

- Consider seasonal expenses: Monsoon repairs, AC bills, school fees

Pro tip: Use Indian apps like Walnut, Money View, or ET Money to track expenses in rupees with Indian spending categories.

2. Build Your Financial Safety Net (Emergency Fund Essentials)

Target amount: 6-12 months of living expenses (Indian families often need larger emergency funds due to extended family responsibilities)

Emergency Fund Strategy for Indians:

- Month 1-3: Save ₹50,000-1,00,000 as starter emergency fund

- Month 4-12: Build to 3 months of expenses

- Year 2: Reach 6-12 months of full expenses

Where to keep it in India:

- High-yield savings accounts: SBI, HDFC, ICICI offering 3-4% interest

- Liquid mutual funds: Better returns than savings accounts with easy redemption

- Fixed deposits: For conservative investors, though returns are taxable

- Sweep-in accounts: Automatic FD creation for excess funds

Remember: In India, emergency funds should also cover family medical emergencies, job market uncertainties, and festival expenses.

3. Build Credit Strategically (Your CIBIL Score Matters)

Your CIBIL score (300-900) affects everything from personal loans to credit card approvals to home loan interest rates. Here's how to build excellent credit in India:

Credit Building in India:

- Start with a secured credit card from your salary account bank

- Keep credit utilization under 30% across all cards

- Pay full amount before due date to avoid interest charges

- Set up auto-debit for minimum payments as backup

- Maintain old credit cards to increase credit history length

Indian Credit Monitoring:

- Check free CIBIL score monthly through bank apps or CIBIL website

- Use apps like CRED, Paisa Bazaar for credit monitoring

- Dispute errors with CIBIL immediately

- Build relationship with your primary bank for better loan terms

4. Start Investing in Indian Markets (Equity for Long-term Wealth)

The earlier you start, the more you benefit from India's growth story. Indian equity markets have delivered 12-15% average returns over long periods.

Investment Priority for Indians:

- EPF contribution (mandatory 12% with employer match)

- ELSS mutual funds for tax saving under Section 80C

- Equity SIPs for wealth creation

- PPF for tax-free long-term savings (15-year lock-in)

- Direct equity once you gain experience

Smart Investment Strategies for Young Indians:

- Start with index funds (Nifty 50, Sensex funds)

- Use SIP (Systematic Investment Plan) for regular investing

- Invest in large-cap and mid-cap funds for balanced growth

- Consider international funds for global diversification

- Use apps like Zerodha, Groww, ET Money for easy investing

Sample Portfolio for Indian 20-somethings:

- 70% equity (mix of large-cap, mid-cap, small-cap, international)

- 20% debt (PPF, EPF, debt funds)

- 10% alternative investments (gold, REITs)

5. Retirement Planning: Achieve ₹5+ Crore Corpus

Goal: Save 15-20% of income for retirement (higher than global average due to limited social security)

Indian Retirement Planning Tools:

- Employees' Provident Fund (EPF): Mandatory 12% contribution

- Public Provident Fund (PPF): ₹1.5 lakh annual limit, 15-year lock-in

- National Pension System (NPS): Additional tax benefits, market-linked returns

- Equity mutual funds: For inflation-beating returns

- Pension plans: Consider only unit-linked plans from reputable insurers

The Power of Starting Early in India:

- Age 22-32: SIP of ₹15,000/month → ₹8 crores at retirement

- Age 32-42: SIP of ₹30,000/month → ₹8 crores at retirement

- Age 42-52: SIP of ₹60,000/month → ₹8 crores at retirement

EPF Strategy: Maximize EPF contributions and consider VPF (Voluntary Provident Fund) for additional tax-free savings at 8.1% returns.

6. Manage Debt Strategically in India

Indian debt landscape requires specific strategies due to high interest rates and family financial responsibilities.

Debt Priority for Indians:

High Priority (Pay off immediately):

- Credit card debt (18-45% interest)

- Personal loans (12-24% interest)

- Gold loans (12-20% interest)

Medium Priority:

- Education loans (8-15% interest, but tax benefits available)

- Two-wheeler loans (10-18% interest)

Low Priority (Manageable):

- Home loans (7-9% interest, tax benefits available)

- Education loans with tax benefits

Indian Debt Management:

- Balance transfer: Move high-interest debt to lower-rate cards

- Loan against securities: Use mutual fund/equity holdings for emergency funds

- Avoid gold loans: Unless absolutely necessary for family emergencies

- Negotiate with banks: Indian banks often offer settlement options

7. Invest in Your Earning Potential

In India's competitive job market, increasing your income is crucial for wealth building.

Career Investment Strategies for Indians:

- Upskill in technology: Data science, AI, digital marketing, coding

- Learn English communication: Still a major career differentiator

- Pursue relevant certifications: CFA, FRM, PMP, cloud certifications

- Build network through LinkedIn: Connect with industry professionals

- Consider government job preparation: For job security and benefits

- Explore freelancing: Leverage India's gig economy growth

Indian Education ROI:

- MBA from top IIMs: High ROI but expensive

- Professional courses: CA, CS, CFA often better ROI than general MBA

- Online certifications: Cost-effective upskilling through Coursera, Udemy

- Foreign education: Calculate forex impact and loan burden carefully

Tax Planning Strategies for Young Indians

Section 80C Investments (₹1.5 lakh limit):

- ELSS mutual funds: Best returns among 80C options

- PPF: Tax-free returns but 15-year lock-in

- Life insurance: Term plans for protection, avoid ULIPs

- Home loan principal: Reduces taxable income

Additional Tax Savings:

- Section 80D: Health insurance premiums

- Section 24: Home loan interest deduction

- NPS: Additional ₹50,000 deduction under 80CCD(1B)

- HRA: If living in rented accommodation

Building Multiple Income Streams in India

Popular Side Hustles for Indians:

- Content creation: YouTube, blogging, Instagram

- Freelancing: Writing, design, coding on Upwork, Fiverr

- Online tutoring: Leverage education background

- E-commerce: Amazon FBA, Flipkart selling

- Real estate: Rental income from second property

- Stock trading: Only after gaining experience

Common Financial Mistakes Young Indians Make

- FD over equity: Keeping too much money in low-return fixed deposits

- Insurance as investment: Buying ULIPs instead of term + mutual funds

- Following stock tips: Losing money on WhatsApp/Telegram tips

- Ignoring inflation: Not accounting for 6-7% annual inflation

- Lifestyle inflation: Spending entire salary increments

- Not planning for parents: Ignoring parents' healthcare and retirement needs

Your 20s Financial Checklist for Indians

By Age 25:

- [ ] Emergency fund of ₹3-5 lakhs

- [ ] CIBIL score above 750

- [ ] SIP of ₹10,000+ monthly

- [ ] Term life insurance of 10x annual income

- [ ] Health insurance for self and parents

By Age 30:

- [ ] Net worth of 5-10x annual salary

- [ ] Investment corpus of ₹10-15 lakhs

- [ ] Diversified portfolio across asset classes

- [ ] Home loan pre-approval (if planning to buy)

- [ ] Clear financial goals for next decade

State-Specific Considerations

Metro Cities (Mumbai, Delhi, Bangalore):

- Higher salary but also higher living costs

- Real estate investment challenging due to high prices

- Better investment options and financial advisory services

Tier-2/Tier-3 Cities:

- Lower cost of living allows higher savings rate

- Limited investment advisory services

- Real estate more affordable

- May need to support family more extensively

The Bottom Line: Start Your Wealth Journey Today

The Indian economy is growing, and young Indians have unprecedented opportunities to build wealth. You don't need lakhs to start"”even a ₹1,000 monthly SIP can grow to significant wealth over time.

Key Success Factors:

- Start early and be consistent

- Focus on equity for long-term wealth

- Use tax-saving instruments wisely

- Increase investments with salary growth

- Stay informed about financial markets

Remember: In India's high-growth environment, time in the market beats timing the market. Your disciplined approach to money management in your 20s will determine whether you achieve financial freedom or struggle with money throughout life.

Ready to start your wealth-building journey? Open a mutual fund account with Zerodha Coin, Groww, or ET Money today. Start with just ₹1,000 monthly SIP and increase it by 10% every year. Your future self will thank you.

Frequently Asked Questions for Indian Investors

Q: How much should I save from my salary in India? A: Aim to save 30-40% of your income: 15-20% for retirement, 10-15% for goals, 5% for emergency fund.

Q: Should I buy a house or invest in mutual funds? A: In expensive cities, invest in mutual funds first. Buy a house only when rental yield makes sense or for emotional satisfaction.

Q: What about gold investment? A: Limit gold to 5-10% of portfolio through Gold ETFs or Gold Bonds, not physical gold.

Q: How to invest with just ₹5,000 salary? A: Start with ₹500 SIP, focus on increasing income through skills, avoid lifestyle inflation.

Written by

Your Finances Team

Helping Indians make better financial decisions through simple, actionable advice.

Continue Reading

50/30/20 Rule for Budgeting in India: A Simple Budgeting Strategy

Okay, let's be real for a minute. If you're reading this, you're probably tired of checking your bank balance and wondering where all your money went. Sound familiar? Don't worry, you're not alone! Wh...

Saving for Retirement in India: A Comprehensive Guide

Planning for retirement is one of the most crucial financial decisions you'll make in your lifetime. In India, where the joint family system is gradually giving way to nuclear families, and traditiona...

Best Savings Accounts in India for 2025: Complete Guide to Maximizing Your Savings

In today's dynamic financial landscape, a savings account remains one of the most fundamental banking products for every Indian. As we move into 2025, choosing the right savings account has become mor...