The Complete Guide to June 2025 Financial Changes in India: What Investors Need to Know

Your Finances Team

Author

June 2025 brings significant financial regulatory changes across India's investment landscape. From SEBI's revised mutual fund transaction timings to anticipated RBI repo rate adjustments and major credit card policy updates from leading banks, these changes will directly impact millions of investors and consumers.

Key Takeaways:

- SEBI introduces new 3 PM cut-off for overnight mutual fund transactions

- RBI may announce third consecutive repo rate cut on June 6, 2025

- Axis Bank and Kotak Mahindra Bank implement major credit card term revisions

- New advance tax deadlines and extended income tax filing dates

SEBI's New Mutual Fund Cut-Off Timing Rules (Effective June 1, 2025)

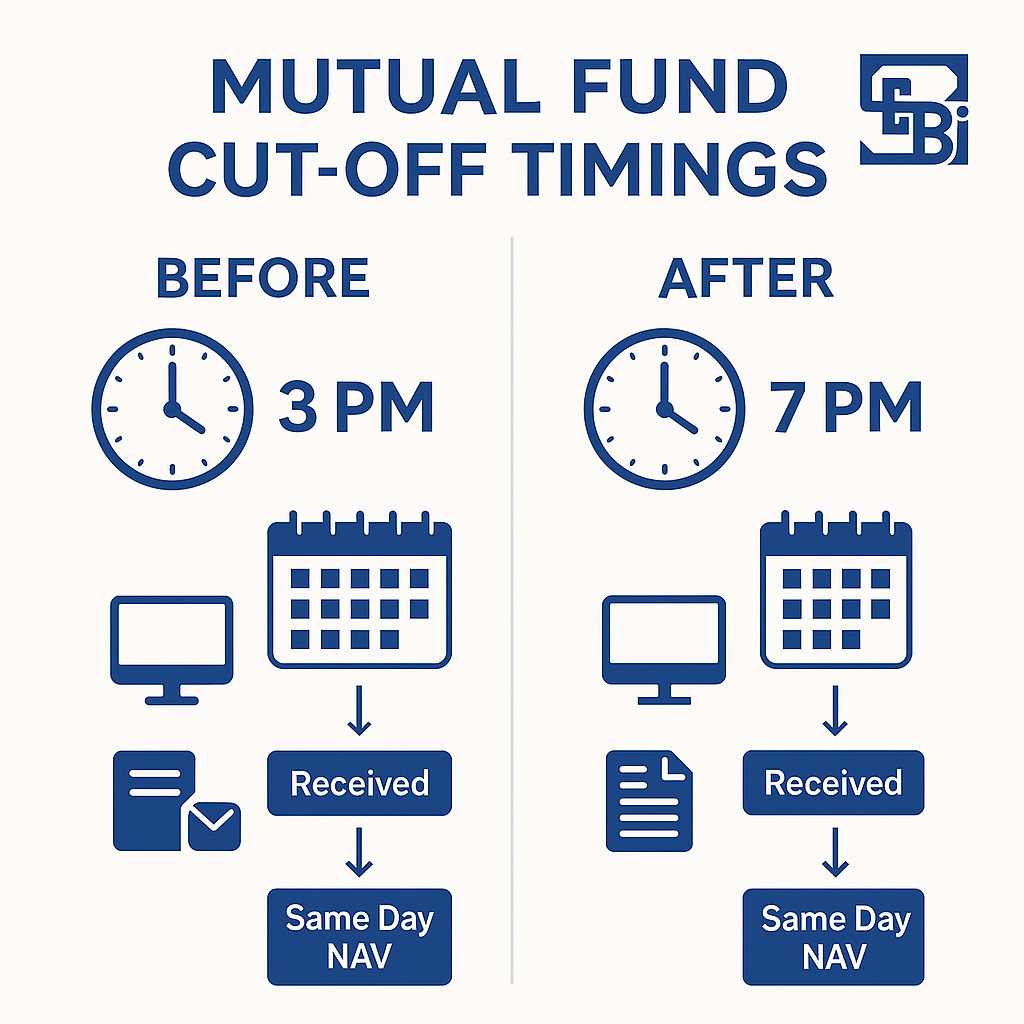

Understanding the New Transaction Windows

The Securities and Exchange Board of India (SEBI) has implemented revised cut-off timings for overnight mutual fund transactions, marking a significant shift in how NAV (Net Asset Value) applications are processed.

New Timing Structure:

| Application Time | Applicable NAV | Transaction Type |

|---|---|---|

| Before 3:00 PM | Previous day's NAV | Standard applications |

| After 3:00 PM | Next business day's NAV | Standard applications |

| Before 7:00 PM | Same day processing | Online applications only |

Impact on Mutual Fund Investors

Advantages:

- Enhanced predictability in NAV allocation

- Improved operational efficiency

- Better alignment with international standards

- Reduced processing delays

Action Items for Investors:

- Update your investment timing strategy

- Plan large transactions before 3 PM for immediate NAV

- Use online platforms for extended 7 PM window

- Review SIP timing if necessary

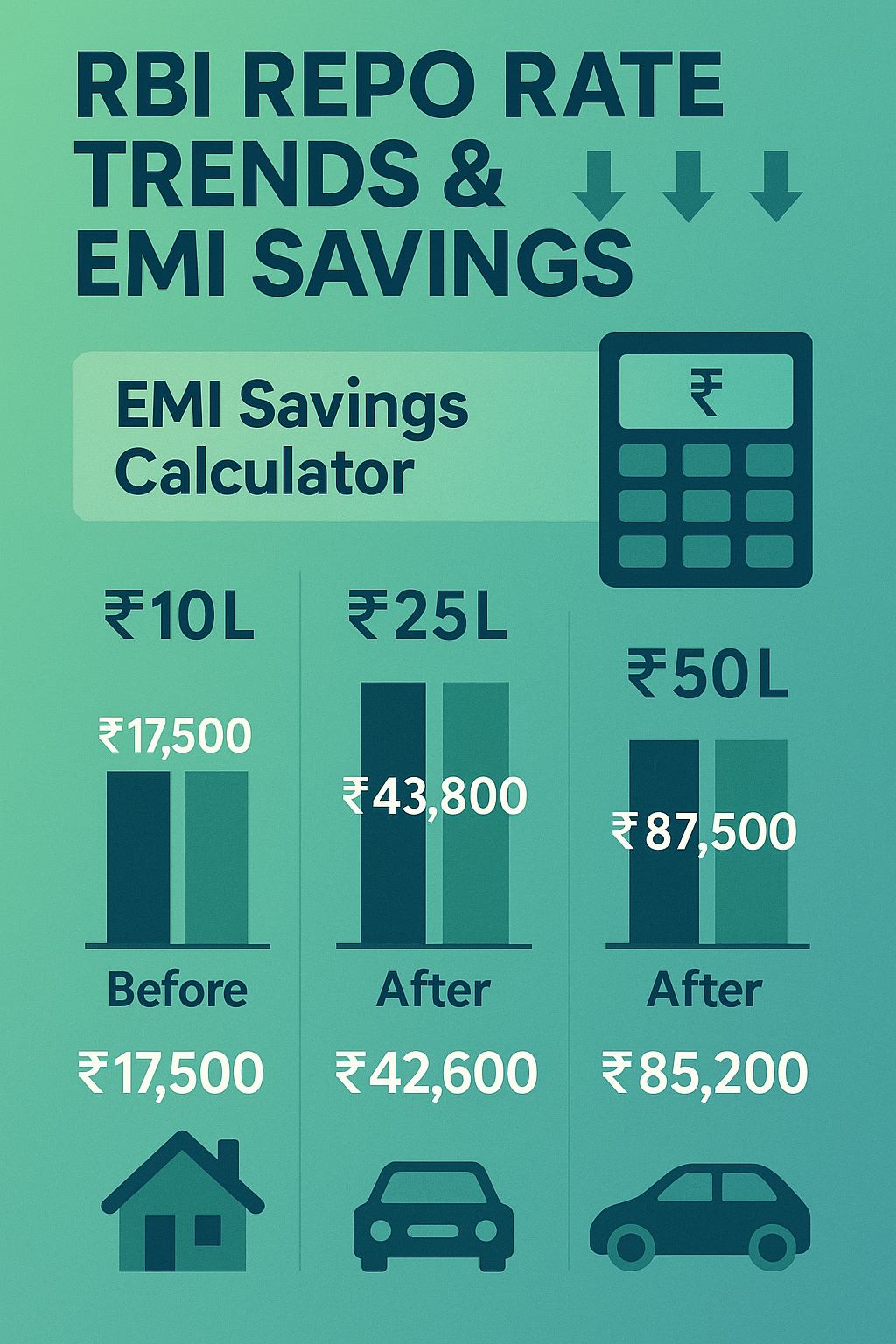

RBI Monetary Policy Update: Potential Third Rate Cut in 2025

What to Expect from June 6, 2025 Policy Review

Market economists anticipate a 25 basis point repo rate reduction, continuing the monetary easing cycle initiated earlier in 2025.

Current Economic Indicators:

- Retail inflation: Below RBI's 4% target

- GDP growth: Stable trajectory

- Previous rate cuts: Two consecutive reductions in 2025

Real Impact on Different Loan Categories

Home Loans:

- Existing borrowers: Immediate EMI reduction

- New applicants: Mixed response from private banks

- Expected savings: ₹500-1,500 per ₹10 lakh loan amount

Personal Loans:

- Variable rate loans: Direct benefit

- Fixed rate loans: No immediate impact

- Credit card interest: Potential reduction

Investment Implications:

- Fixed deposits: Lower returns expected

- Debt mutual funds: Potential capital gains

- Equity markets: Positive sentiment boost

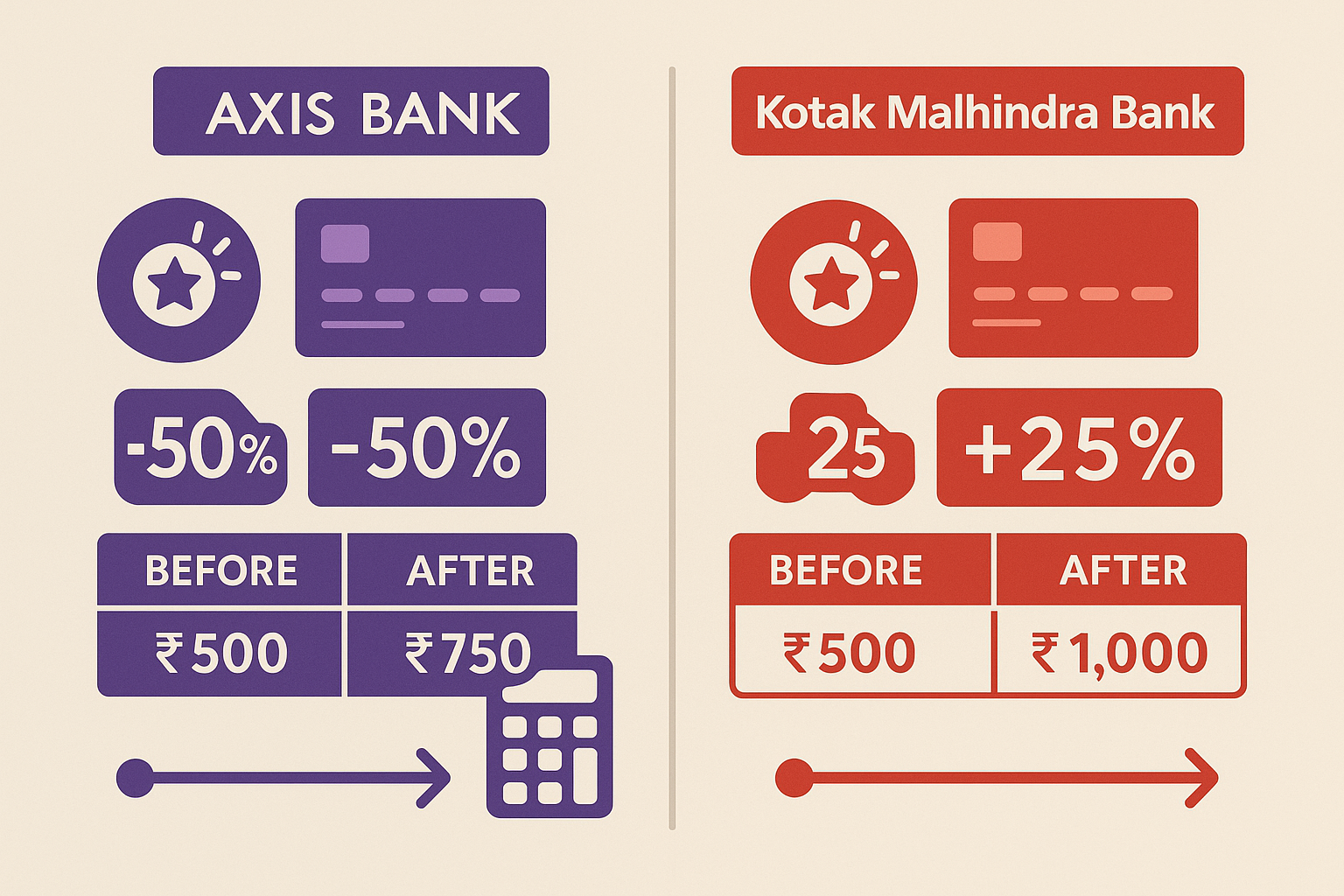

Major Credit Card Policy Updates: Axis Bank & Kotak Mahindra Bank

Axis Bank Credit Card Changes (Effective June 20, 2025)

Magnus Card Revisions:

- Reward structure: Now tier-based on spending thresholds

- Annual spending requirement: ₹1.5 lakh for premium benefits

- Cashback caps: New limits on e-commerce platforms

Detailed Impact Analysis:

| Spending Range | Old Reward Rate | New Reward Rate | Net Impact |

|---|---|---|---|

| ₹0 - ₹1L | 4X points | 2X points | -50% rewards |

| ₹1L - ₹1.5L | 4X points | 3X points | -25% rewards |

| ₹1.5L+ | 4X points | 4X points | No change |

Kotak Mahindra Bank Updates (Effective June 1, 2025)

Key Changes:

- Reward redemption value: Reduced by 20%

- Annual fees: Increased across premium card categories

- Interest rates: 0.5% increase on outstanding balances

- Late payment charges: Enhanced penalty structure

Optimization Strategies:

- Review monthly spending patterns

- Consider card category downgrade if beneficial

- Explore alternative reward credit cards

- Set up automatic payments to avoid penalties

Tax Planning Deadlines and Extensions for 2025

Critical Dates for Financial Planning

Advance Tax Schedule:

- June 15, 2025: First installment (15% of total liability)

- September 15, 2025: Second installment (45% cumulative)

- December 15, 2025: Third installment (75% cumulative)

- March 15, 2026: Final installment (100%)

Income Tax Return Filing:

- Extended deadline: September 15, 2025 (for individuals)

- Previous deadline: July 31, 2025

- Late filing penalty: ₹1,000 (income < ₹5 lakh), ₹5,000 (income > ₹5 lakh)

Strategic Tax Planning Actions

- Calculate advance tax liability using updated income projections

- Organize documentation early despite extended deadline

- Review investment options for tax saving under Section 80C

- Consider tax-loss harvesting opportunities

Strategic Implementation Guide: Navigating the Changes

Immediate Action Plan (Within 30 Days)

For Mutual Fund Investors: â–¡ Update SIP and investment timings â–¡ Review fund selection based on new processing windows â–¡ Adjust large transaction planning

For Loan Holders: â–¡ Contact bank about repo rate transmission â–¡ Review loan restructuring opportunities â–¡ Compare rates across different lenders

For Credit Card Users: â–¡ Analyze reward earning patterns â–¡ Evaluate card portfolio optimization â–¡ Set up automatic payment systems

Medium-term Strategy (3-6 Months)

- Portfolio rebalancing based on new rate environment

- Credit card portfolio optimization for maximum rewards

- Tax planning alignment with new deadlines

- Emergency fund review considering changed interest rates

Expert Recommendations and Best Practices

Risk Management Considerations

Financial Disclaimer: This article provides general information and should not be considered as personalized financial advice. Consult with qualified financial advisors before making investment decisions. All financial products carry inherent risks.

Key Risk Factors:

- Regulatory changes may continue evolving

- Interest rate cycles can reverse

- Credit card terms subject to further modifications

- Tax regulations may see additional updates

Professional Guidance

Consider consulting with:

- Certified Financial Planners for comprehensive strategy

- Tax consultants for optimization opportunities

- Investment advisors for portfolio adjustments

- Banking relationship managers for personalized solutions

Conclusion: Staying Ahead of Financial Changes

The June 2025 financial landscape changes represent significant opportunities for informed investors and consumers. By understanding these modifications and implementing strategic adjustments, individuals can optimize their financial positions while managing associated risks.

Next Steps:

- Review your current financial portfolio against these changes

- Implement recommended action items based on your situation

- Stay updated with official notifications from regulators

- Consider professional consultation for complex scenarios

Additional Resources

Official Sources:

Tools and Calculators:

- EMI calculators for rate change impact

- Mutual fund NAV calculators

Written by

Your Finances Team

Helping Indians make better financial decisions through simple, actionable advice.

Continue Reading

New PSU Pension Rules 2025: Complete Guide to CCS Amendment - 7 Benefits at Risk for Government Employees

Breaking News: What Changed in May 2025 The Government of India issued a critical amendment to pension regulations on May 22, 2025, through G.S.R. 340(E) under the Ministry of Personnel, Public Grieva...

Unified Pension Scheme (UPS): Everything You Need to Know in 2025

Ready to decode the pension game that's about to change everything for government employees? The Unified Pension Scheme (UPS) just dropped and it's literally the pension revolution we've been waiting ...

Nifty and Bank Nifty Analysis for 26th May 2025 : Mixed Signals Point to Critical Week Ahead

The Indian equity markets are at a crucial juncture, with both Nifty and Bank Nifty displaying contrasting technical and sentiment indicators that suggest significant price movements could be on the h...