50/30/20 Rule for Budgeting in India: A Simple Budgeting Strategy

Your Finances Team

Author

Okay, let's be real for a minute. If you're reading this, you're probably tired of checking your bank balance and wondering where all your money went. Sound familiar?

Don't worry, you're not alone! Whether you're a college student surviving on pocket money, a fresh graduate navigating your first salary, or someone who just wants to get their financial game together, we've got your back.

The 50/30/20 rule isn't just another boring finance tip your parents keep talking about "“ it's actually a game-changer that can help you manage your money without feeling like you're living on instant noodles forever. Think of it as the perfect balance between being financially responsible and still having a life.

Ready to stop living paycheck to paycheck and actually start building some wealth? Let's dive in!

What is the 50/30/20 Budget Rule?

The 50/30/20 budgeting rule is one of the simplest and most effective money management strategies you'll ever come across. This rule helps you divide your after-tax income into three main categories:

- 50% for Needs (Essential Expenses)

- 30% for Wants (Lifestyle Expenses)

- 20% for Savings and Investments

This budgeting method was popularized by Elizabeth Warren, a Harvard bankruptcy expert, in her book "All Your Worth: The Ultimate Lifetime Money Plan." The beauty of this rule lies in its simplicity "“ you don't need complex spreadsheets or financial expertise to implement it.

Why This Rule Works in India

The 50/30/20 rule is particularly effective for Indian households because it:

- Accommodates Family Responsibilities: Indian culture emphasizes family support, and this rule allows flexibility for family-related expenses

- Balances Tradition and Modernity: It respects traditional saving habits while allowing for modern lifestyle choices

- Suits Various Income Levels: Whether you earn ₹25,000 or ₹2,50,000 per month, the percentages remain applicable

- Promotes Financial Discipline: It creates a structured approach to money management

Breaking Down the 50/30/20 Rule for Indian Context

50% for Needs (Essential Expenses)

Your "needs" are expenses you absolutely cannot avoid. In the Indian context, these typically include:

Housing Costs:

- Rent or EMI payments

- Property maintenance

- Electricity, water, and gas bills

- Housing society charges

- Security deposits

Food and Groceries:

- Monthly grocery shopping

- Cooking gas refills

- Basic food items and vegetables

- Milk and dairy products

Transportation:

- Fuel costs for personal vehicles

- Public transport expenses

- Auto/taxi fares for essential travel

- Vehicle maintenance and insurance

Insurance and Healthcare:

- Health insurance premiums

- Life insurance premiums

- Basic medical expenses

- Regular health check-ups

Family Obligations:

- Support for parents or dependents

- Children's school fees (basic education)

- Essential clothing

Debt Payments:

- Minimum payments on credit cards

- Personal loan EMIs

- Education loan payments

30% for Wants (Lifestyle Expenses)

"Wants" are things that enhance your lifestyle but aren't absolutely necessary for survival:

Entertainment and Social Life:

- Movie tickets and OTT subscriptions

- Dining out at restaurants

- Weekend trips and short vacations

- Parties and celebrations

Shopping and Personal Care:

- Fashion and designer clothing

- Cosmetics and beauty products

- Gadgets and electronics

- Hobby-related purchases

Premium Services:

- High-speed internet upgrades

- Premium mobile plans

- Gym memberships

- Salon and spa visits

Lifestyle Upgrades:

- Brand preferences in food and products

- Convenience services (food delivery, cab rides)

- Home decor and furniture upgrades

20% for Savings and Investments

This portion is crucial for your financial future:

Emergency Fund:

- 6-12 months of expenses

- Liquid savings in bank accounts

- Fixed deposits for quick access

Retirement Planning:

- Employee Provident Fund (EPF)

- Public Provident Fund (PPF)

- National Pension System (NPS)

- Retirement mutual funds

Investment Options:

- Systematic Investment Plans (SIPs) in mutual funds

- Direct equity investments

- Unit Linked Insurance Plans (ULIPs)

- Real estate investments

Goal-Based Savings:

- Children's education fund

- Marriage expenses

- Home down payment

- Car purchase fund

Tax-Saving Investments:

- ELSS mutual funds

- National Savings Certificate (NSC)

- Tax-saving fixed deposits

- Life insurance premiums

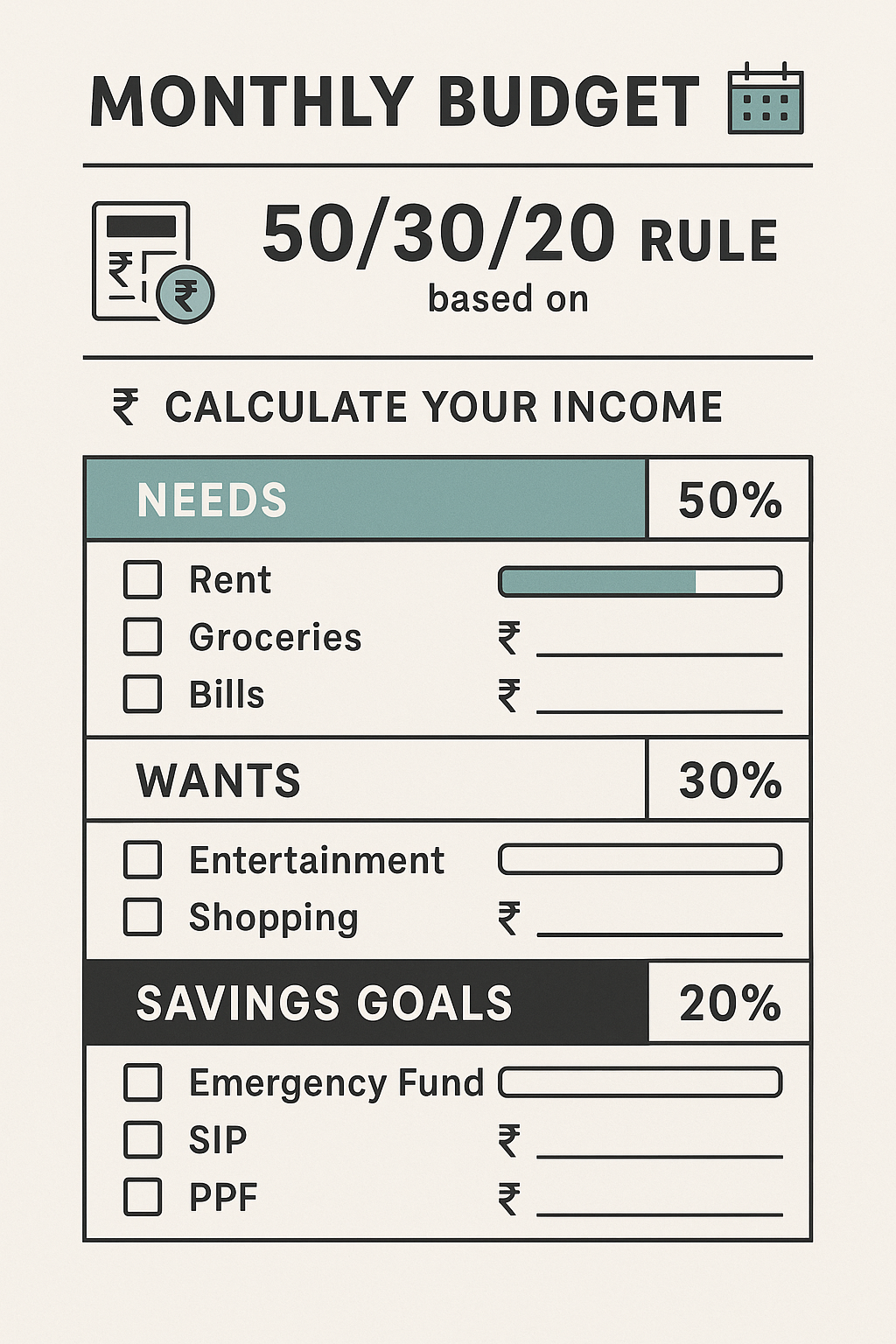

Step-by-Step Implementation Guide

Step 1: Calculate Your After-Tax Income

Start by determining your monthly take-home salary after all deductions:

For Salaried Individuals:

- Basic salary + allowances

- Minus: Income tax, EPF, professional tax

- Minus: Health insurance deductions

- Result = Monthly take-home income

For Business Owners/Freelancers:

- Total monthly revenue

- Minus: Business expenses

- Minus: Estimated tax liability

- Result = Monthly disposable income

Step 2: Apply the 50/30/20 Formula

Let's say your monthly take-home income is ₹50,000:

- Needs Budget: ₹50,000 × 50% = ₹25,000

- Wants Budget: ₹50,000 × 30% = ₹15,000

- Savings Budget: ₹50,000 × 20% = ₹10,000

Step 3: Track Your Current Expenses

Before implementing the rule, track your expenses for one month:

- Use Mobile Apps: Apps like Money Manager, Walnut, or ET Money

- Digital Banking: Review your bank statements and credit card bills

- Receipt Collection: Keep all physical receipts for cash transactions

- Categorize Expenses: Sort them into needs, wants, and savings

Step 4: Adjust Your Spending Patterns

If your current spending doesn't align with the 50/30/20 rule:

If Needs Exceed 50%:

- Look for ways to reduce housing costs (consider flatmates)

- Optimize grocery shopping (buy in bulk, choose generic brands)

- Use public transport instead of private cabs

- Review and reduce unnecessary subscriptions

If Wants Exceed 30%:

- Set a monthly entertainment budget

- Reduce impulse purchases

- Choose home-cooked meals over restaurant dining

- Find free or low-cost entertainment options

If Savings Fall Short of 20%:

- Automate savings through SIPs

- Increase income through side hustles

- Review and optimize your needs and wants categories

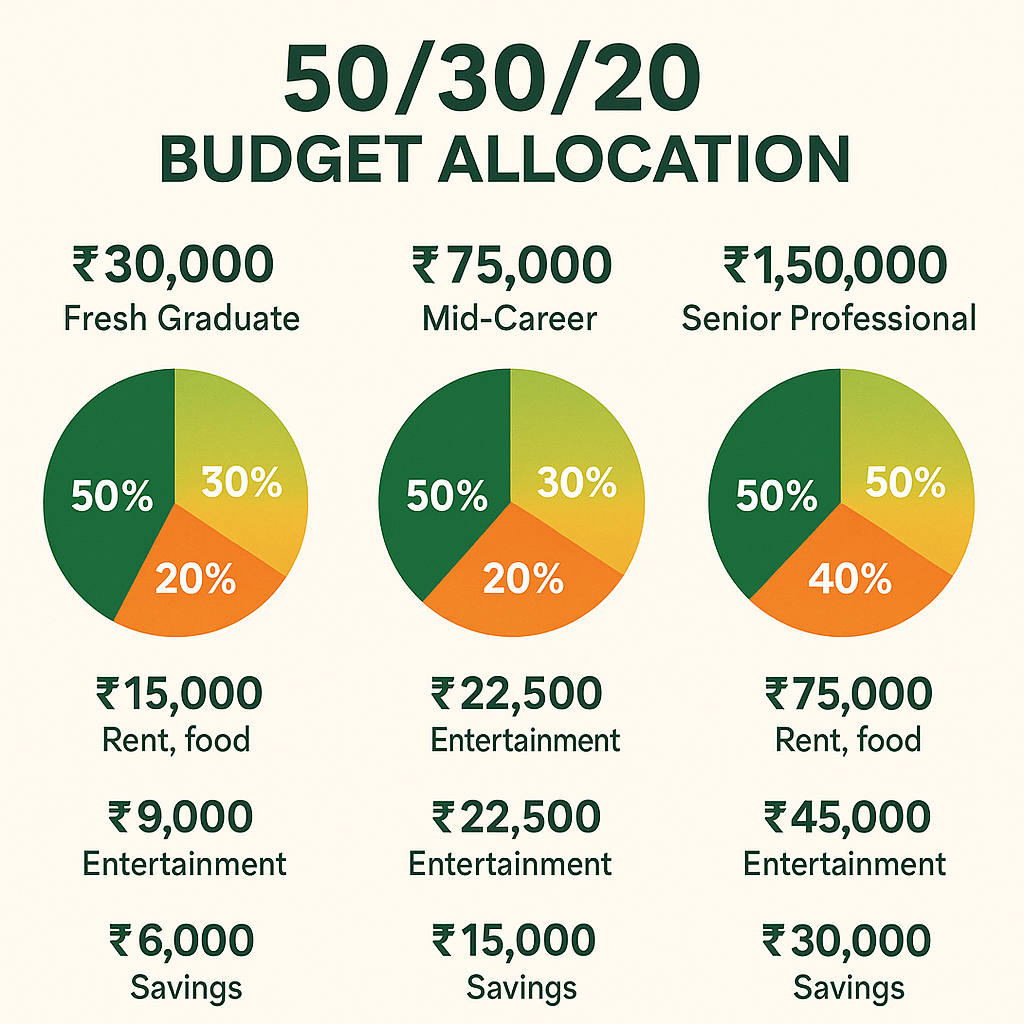

Real-Life Examples for Different Income Levels

Example 1: Fresh Graduate (₹30,000/month)

Monthly Income: ₹30,000

Needs (₹15,000):

- Rent (shared accommodation): ₹8,000

- Food and groceries: ₹4,000

- Transportation: ₹1,500

- Mobile and internet: ₹800

- Basic healthcare: ₹700

Wants (₹9,000):

- Entertainment and dining out: ₹3,000

- Shopping and personal care: ₹2,500

- Miscellaneous lifestyle expenses: ₹3,500

Savings (₹6,000):

- Emergency fund: ₹2,000

- SIP in mutual funds: ₹3,000

- PPF contribution: ₹1,000

Example 2: Mid-Career Professional (₹75,000/month)

Monthly Income: ₹75,000

Needs (₹37,500):

- Home loan EMI: ₹18,000

- Utilities and maintenance: ₹3,000

- Groceries and household: ₹6,000

- Transportation: ₹3,500

- Insurance premiums: ₹2,500

- Family support: ₹4,500

Wants (₹22,500):

- Dining and entertainment: ₹6,000

- Travel and vacations: ₹5,000

- Shopping and upgrades: ₹4,000

- Hobbies and fitness: ₹3,500

- Miscellaneous: ₹4,000

Savings (₹15,000):

- Emergency fund: ₹3,000

- Equity mutual funds: ₹6,000

- PPF and ELSS: ₹3,000

- Child education fund: ₹3,000

Example 3: Senior Professional (₹1,50,000/month)

Monthly Income: ₹1,50,000

Needs (₹75,000):

- Home loan EMI: ₹35,000

- Utilities and maintenance: ₹8,000

- Groceries and household: ₹12,000

- Transportation: ₹8,000

- Insurance and healthcare: ₹6,000

- Family and domestic help: ₹6,000

Wants (₹45,000):

- Premium dining and entertainment: ₹12,000

- Travel and luxury experiences: ₹15,000

- Shopping and lifestyle: ₹8,000

- Fitness and wellness: ₹5,000

- Miscellaneous premium services: ₹5,000

Savings (₹30,000):

- Emergency fund: ₹5,000

- Diversified mutual funds: ₹12,000

- Direct equity investments: ₹5,000

- Real estate investment: ₹5,000

- Children's future planning: ₹3,000

Common Challenges and Solutions

Challenge 1: High Housing Costs in Metro Cities

Problem: Rent or EMI consumes more than 50% of income

Solutions:

- Consider locations slightly farther from city center

- Opt for shared accommodation or co-living spaces

- Look into company-provided housing assistance

- Consider buying a smaller property with lower EMI

Challenge 2: Family Financial Responsibilities

Problem: Supporting parents or extended family exceeds budget allocation

Solutions:

- Have open family discussions about financial planning

- Encourage family members to build their own emergency funds

- Create a separate family support budget category

- Look for ways to increase overall household income

Challenge 3: Irregular Income (Freelancers/Business Owners)

Problem: Monthly income varies significantly

Solutions:

- Calculate average monthly income over 6-12 months

- Build a larger emergency fund (12+ months of expenses)

- Use percentage-based budgeting during high-income months

- Maintain separate accounts for business and personal expenses

Challenge 4: High Cost of Living vs Income

Problem: Basic needs exceed 50% of income in expensive cities

Solutions:

- Focus on increasing income through skill development

- Explore side hustles or additional income streams

- Temporarily adjust ratios (60/25/15) while working on income growth

- Consider relocating to more affordable areas if possible

Advanced Tips for Maximizing the 50/30/20 Rule

Optimize Your Needs Category

- Smart Grocery Shopping:

- Buy seasonal vegetables and fruits

- Use grocery apps for discounts and cashback

- Plan weekly menus to avoid food waste

- Buy non-perishables in bulk

- Reduce Transportation Costs:

- Use public transport during off-peak hours

- Consider carpooling or bike-sharing options

- Maintain your vehicle properly to improve fuel efficiency

- Walk or cycle for short distances

- Lower Housing Expenses:

- Negotiate rent during lease renewals

- Invest in energy-efficient appliances

- Share utility costs with flatmates

- Choose housing closer to work to save on commuting

Make Your Wants More Meaningful

- Quality Over Quantity:

- Invest in durable, high-quality items

- Choose experiences over material possessions

- Research before making significant purchases

- Wait 24-48 hours before impulse buying

- Find Cost-Effective Alternatives:

- Use free or low-cost entertainment options

- Explore local tourism instead of expensive destinations

- Cook restaurant-style meals at home

- Share subscriptions with family or friends

Supercharge Your Savings

- Automate Everything:

- Set up automatic transfers to savings accounts

- Use SIP for mutual fund investments

- Enable auto-debit for insurance premiums

- Schedule recurring deposits

- Maximize Tax Benefits:

- Contribute to Section 80C instruments

- Use National Pension System for additional deduction

- Invest in health insurance for medical tax benefits

- Plan investments to optimize tax liability

- Diversify Your Portfolio:

- Mix of debt and equity instruments

- Include international funds for global exposure

- Consider real estate through REITs

- Keep some liquid funds for emergencies

Technology Tools and Apps for Budget Management

Popular Budgeting Apps in India

- Money Manager (Expense & Budget)

- Simple expense tracking

- Category-wise budget setting

- Visual reports and charts

- Multi-currency support

- ET Money

- Comprehensive financial planning

- Investment tracking

- Goal-based planning

- Tax optimization features

- Walnut (formerly Wallaby)

- Automatic expense tracking via SMS

- Bill payment reminders

- Credit score monitoring

- Budget analysis

- YNAB (You Need A Budget)

- Zero-based budgeting approach

- Real-time sync across devices

- Educational resources

- Goal tracking features

Banking Tools

- Digital Banking Apps:

- Expense categorization features

- Automatic savings programs

- Investment options integration

- Spending analysis tools

- UPI Payment Tracking:

- Monitor all digital transactions

- Category-wise expense sorting

- Monthly spending summaries

- Merchant-wise analysis

Long-term Benefits of Following the 50/30/20 Rule

Financial Security

- Emergency Preparedness:

- Build substantial emergency funds

- Reduce dependency on credit during crises

- Handle unexpected expenses without stress

- Maintain lifestyle during income disruptions

- Debt Management:

- Avoid unnecessary borrowing

- Maintain healthy credit utilization

- Build strong credit history

- Have funds for major purchases

Wealth Building

- Compound Growth:

- Consistent investment leads to wealth multiplication

- Early start provides time advantage

- Disciplined savings create substantial corpus

- Multiple income streams through investments

- Financial Independence:

- Achieve major life goals without debt

- Create passive income sources

- Build retirement corpus

- Have flexibility in career choices

Lifestyle Benefits

- Stress Reduction:

- No constant worry about money

- Clear spending guidelines

- Guilt-free enjoyment of wants category

- Peace of mind about the future

- Better Decision Making:

- Conscious spending choices

- Long-term perspective on purchases

- Value-based financial decisions

- Improved financial literacy

Adapting the Rule for Indian Festivals and Special Occasions

Festival Season Planning

Indian festivals often involve significant expenses. Here's how to accommodate them:

- Create a Festival Fund:

- Allocate a portion of your wants category

- Save specifically for major festivals

- Plan purchases in advance for better deals

- Set realistic budgets for gifts and celebrations

- Seasonal Adjustments:

- During festival months, temporarily adjust ratios

- Reduce non-essential wants to accommodate festival expenses

- Use festival bonuses wisely

- Focus on meaningful celebrations over extravagant spending

Wedding and Life Event Planning

- Long-term Goal Setting:

- Start saving for major life events early

- Create separate sinking funds

- Consider the cultural expectations while budgeting

- Balance tradition with financial reality

- Smart Wedding Planning:

- Prioritize meaningful elements over show-off expenses

- Consider intimate celebrations

- Plan payment schedules with vendors

- Keep emergency funds intact during major events

Regional Variations and Cost Considerations

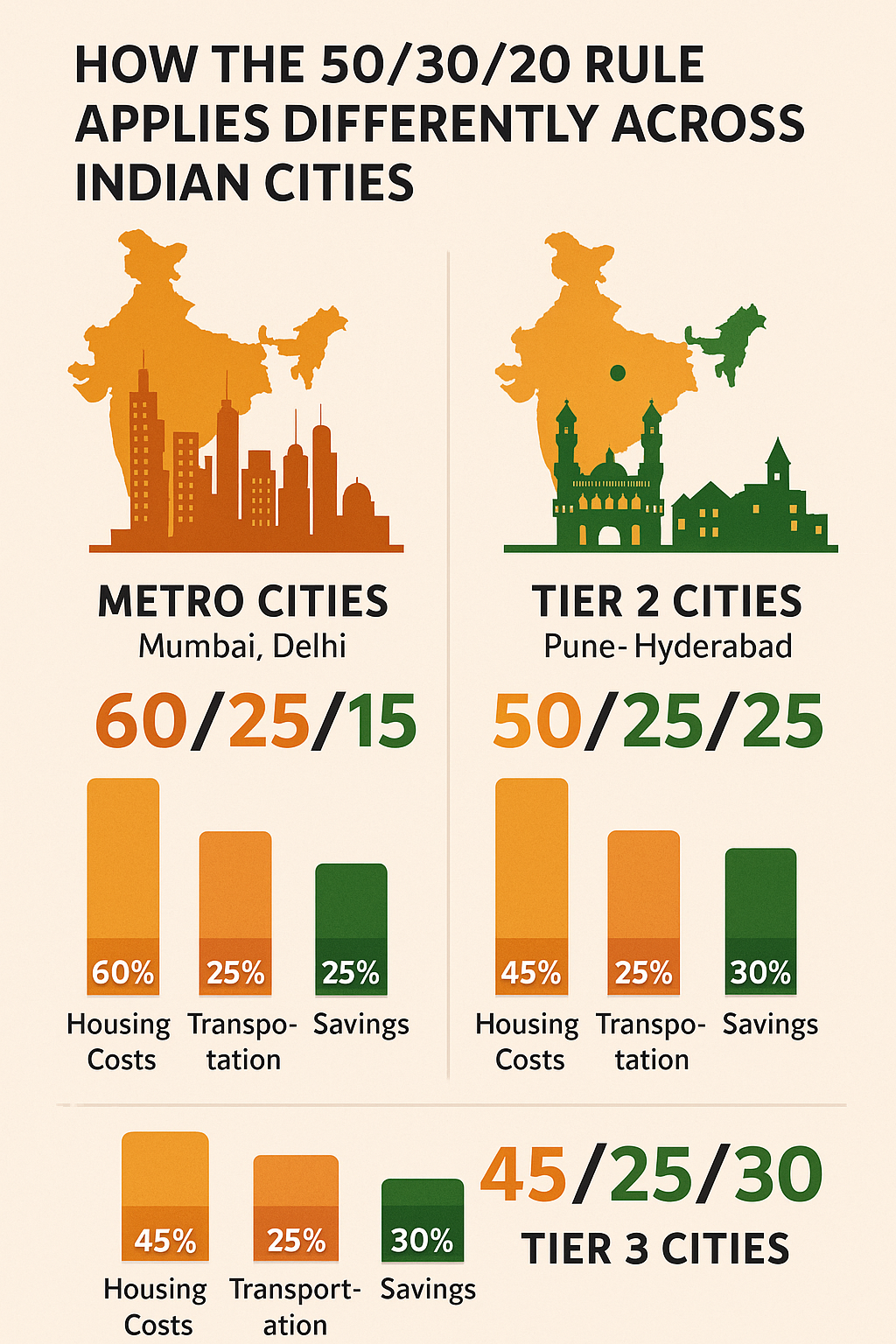

Metro Cities (Mumbai, Delhi, Bangalore, Chennai)

Unique Challenges:

- Higher housing costs (often 40-60% of income)

- Expensive transportation and parking

- Premium pricing for basic services

- Higher lifestyle expenses

Adaptations:

- Consider 60/25/15 ratio initially

- Focus on increasing income aggressively

- Utilize city benefits (public transport, cultural events)

- Network for better opportunities

Tier 2 Cities (Pune, Hyderabad, Ahmedabad, Kolkata)

Advantages:

- More affordable housing options

- Lower transportation costs

- Better work-life balance possibilities

- Growing job opportunities

Optimizations:

- Stick closer to 50/30/20 rule

- Invest savings in growth opportunities

- Consider real estate investments

- Build multiple income streams

Tier 3 Cities and Towns

Benefits:

- Significantly lower living costs

- Strong family support systems

- Lower stress lifestyle

- Higher savings potential

Strategies:

- Achieve even better than 20% savings rate

- Focus on online income opportunities

- Invest in education and skill development

- Consider 45/25/30 for aggressive wealth building

Common Mistakes to Avoid

Budgeting Errors

- Underestimating Needs:

- Forgetting irregular but essential expenses

- Not accounting for inflation

- Ignoring seasonal variations

- Underbudgeting for healthcare

- Overestimating Willpower:

- Setting unrealistic want budgets

- Not accounting for social pressures

- Ignoring personal spending patterns

- Creating overly restrictive budgets

Implementation Mistakes

- Perfectionism:

- Expecting immediate perfect adherence

- Getting discouraged by small deviations

- Overcomplicating the tracking process

- Not allowing for learning curve

- Inconsistency:

- Not tracking expenses regularly

- Failing to review and adjust

- Ignoring changing life circumstances

- Not automating savings and investments

When to Modify the 50/30/20 Rule

Life Stage Adjustments

- Early Career (Ages 22-30):

- May need 60/30/10 initially due to lower income

- Focus on skill development and income growth

- Build emergency fund first

- Consider aggressive investment once stable

- Family Building (Ages 30-45):

- Needs may increase to 55-60%

- Children's expenses impact all categories

- Insurance becomes more critical

- Education planning becomes priority

- Pre-Retirement (Ages 45-60):

- Savings should increase to 25-30%

- Healthcare costs may rise

- Focus on debt elimination

- Conservative investment approach

Income Changes

- Salary Increases:

- Avoid lifestyle inflation

- Increase savings percentage first

- Gradually increase wants category

- Maintain needs percentage or reduce it

- Income Reduction:

- Immediately adjust all categories

- Focus on needs optimization

- Temporarily reduce savings if necessary

- Explore additional income sources

Building Financial Discipline

Creating Sustainable Habits

- Start Small:

- Begin with loose adherence to the rule

- Gradually tighten budget discipline

- Celebrate small wins

- Focus on consistency over perfection

- Make It Automatic:

- Set up automatic savings transfers

- Use standing instructions for investments

- Create separate accounts for each category

- Minimize manual financial decisions

Staying Motivated

- Visualize Goals:

- Create clear financial milestones

- Track progress regularly

- Share goals with supportive friends/family

- Reward yourself for achieving targets

- Educate Continuously:

- Read financial blogs and books

- Attend financial literacy seminars

- Join online communities

- Learn from others' experiences

Conclusion

The 50/30/20 budgeting rule offers a practical and flexible framework for managing money in the Indian context. While it may seem challenging initially, especially in expensive metro cities, the long-term benefits far outweigh the short-term adjustments required.

Remember that this rule is a guideline, not a rigid law. Your personal circumstances, life stage, income level, and goals should influence how you implement it. The key is to start somewhere and adjust as you learn more about your spending patterns and financial priorities.

Success with the 50/30/20 rule requires:

- Honest assessment of your current financial situation

- Willingness to make necessary lifestyle adjustments

- Consistent tracking and monitoring

- Regular review and optimization

- Patience and persistence

Start implementing this rule today, even if imperfectly. Track your expenses for a month, identify areas for improvement, and gradually align your spending with the 50/30/20 framework. Your future self will thank you for taking this important step toward financial security and independence.

The journey to financial wellness is a marathon, not a sprint. The 50/30/20 rule provides a proven roadmap, but your commitment and consistency will determine how quickly you reach your destination. Take the first step today, and build the financially secure future you deserve.

Written by

Your Finances Team

Helping Indians make better financial decisions through simple, actionable advice.

Continue Reading

Money Management Guide for 20-Somethings: Indian Financial Planning Made Simple

Your twenties are the most crucial decade for building wealth and achieving financial independence in India. With rising inflation, increasing living costs, and the need for financial security, the mo...

Saving for Retirement in India: A Comprehensive Guide

Planning for retirement is one of the most crucial financial decisions you'll make in your lifetime. In India, where the joint family system is gradually giving way to nuclear families, and traditiona...

Best Savings Accounts in India for 2025: Complete Guide to Maximizing Your Savings

In today's dynamic financial landscape, a savings account remains one of the most fundamental banking products for every Indian. As we move into 2025, choosing the right savings account has become mor...